This article was originally published in the Brand Finance Olympics Journal 2024

From an ode to the gods to a multi-billion-dollar business, the Olympic Games have evolved over the years and so has the brand. In 2024, Brand Finance data indicates the Olympics brand has a value of USD11.4 billion.

Although considered a global brand, it originates in Greece, where the Olympics brand is nearly 5.5 time more valuable than the top 10 most valuable brands from Greece combined.

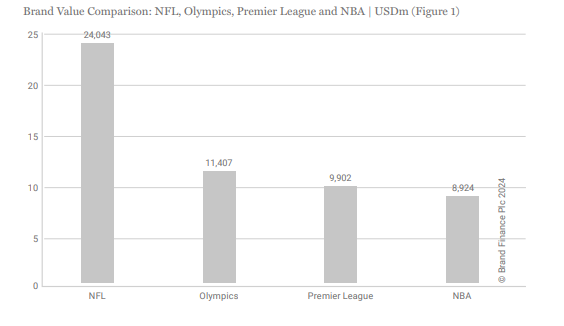

HOW THE OLYMPICS STACK UP

In terms of brand value, the Olympics are in the same league as other sporting giants. The English Premier League is the most-watched sports league in the world, according to the British Council, broadcast to 188 countries. Brand Finance values the English Premier League at USD9.9 billion (Figure 1) based on the 20 component clubs in 2024, which is nearly as valuable as the Olympic brand. The only sports league more valuable is the NFL at USD24.0 billion based on the sum of all 32 of the NFL franchise teams.

The Olympics’ brand value is especially impressive considering the games are played out over just over 2 weeks every couple of years, compared to leagues that play over half the year, every year. For instance, when compared to the NBA, whose 30 teams brand value equal to USD8.9 billion, the Olympics is still a more valuable brand.

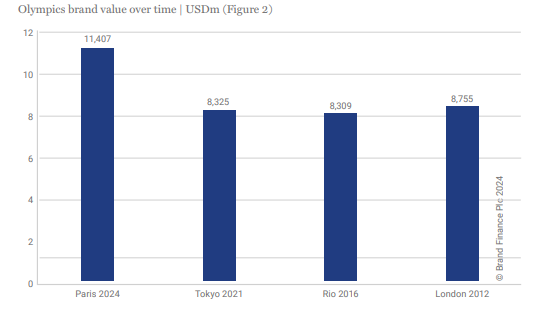

Following the abbreviated and delayed Tokyo Olympics 2020, Paris 2024 made a grand entrance, giving a big boost to the brand – a 37% increase in value from 2021, when it was valued at USD8.3 billion. This surge in value can be attributed to growing broadcasting deals, more stable sponsorship revenue, and post pandemic hopes of normality (Figure 2).

HOW THE OLYMPICS BRAND VALUE IS DERIVED

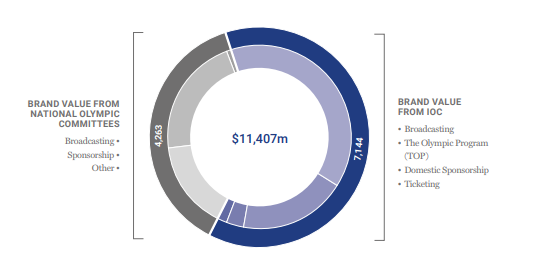

Brands have value because they drive financial benefits to companies by positively influencing different stakeholder groups. The Olympics brand influences the success of the IOC and NOCs across their various revenue generating activities, primarily broadcasting, sponsorship, and ticketing. Brand Finance’s valuation of the Olympics uses the royalty relief methodology and applies a hypothetical royalty rate to the different revenue generating aspects of the Olympics: the International Olympic Committee (IOC) and the 206 National Olympic Committees (NOCs). The valuation is calculated as the net present value of this stream of royalties that the brand is expected to deliver across each of these revenue streams into the future.

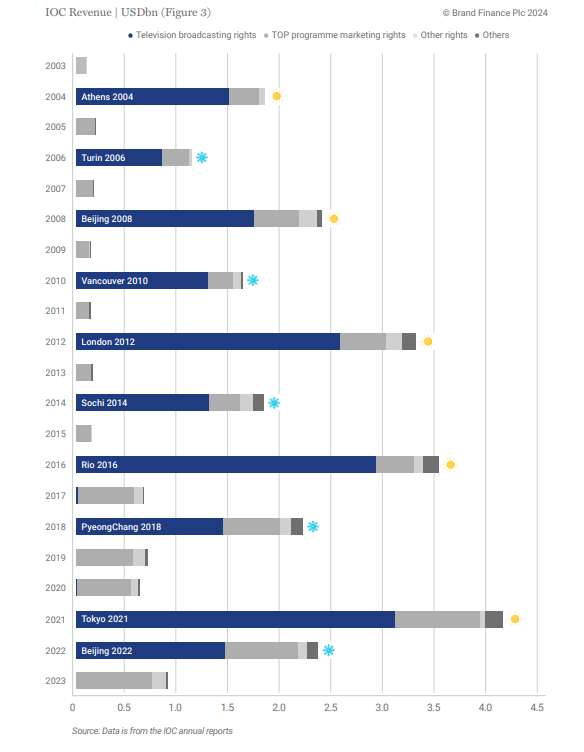

Although the IOC’s revenue is concentrated in Olympic years as broadcasting rights are sold, broadcasting rights are the largest driver of revenue and Olympic brand value (Figure 3). The 2024 brand value growth is bolstered by these lucrative agreements, for instance, the reported USD1.5 billion deal the IOC secured with Warner Bros Discovery for broadcasting rights to the games from 2018 – 2024, now renewed through 2032 and expanded to include EBU. The redistribution of the broadcast revenues to NOCs is an important driver of investment into infrastructure and athlete performance within nations.

Sponsorship is the second major contributor to the value of the Olympic brand, representing USD4.9 billion of brand value (Figure 4). Since 2017, the revenue from sponsorship has expanded not only in size but also in terms of positively impacting financial performance during non-Olympic years.

This has resulted in a significant boost in overall IOC income and further contributed to the growth of the Olympics brand value.

In exchange for a substantial financial commitment, sponsors expect to receive extensive global brand awareness and exposure, as well as the opportunity to build up their own brands by leveraging the positive perceptions associated with the Olympics brand. The Olympic Partner (TOP) programme is a global sponsorship programme managed by the IOC which grants its members global marketing rights to the Olympic and Paralympic Games and Olympic teams around the world. TOP is the highest level of Olympic Sponsorship. Some of these partners also provide essential services and products to the host games such as timekeeping (Omega) or Cybersecurity (Atos). IOC revenue from the TOP programme in the year of the 2020 Tokyo games was USD800 million. See a full analysis of TOP sponshorship investments and returns on page 17.

However, NOCs are also entitled to negotiate individual brand deals where they need not share any of the relevant sponsorship income brought in. This has been the most lucrative revenue generating stream for NOCs. This highlights the importance of local and national sponsors in supporting the Olympic movement at the country level, where funding is crucial to developing and supporting athletes. Local sponsorship is also a way to mitigate large discrepancies that also arise from country to country when it comes to sponsorship revenue – for instance, the USA was rewarded 11 time more than the UK in 2024.

Ticketing is the smallest of the revenue generators for the IOC, contributing USD200 million in brand value. The Olympics ticketing strategy generally prioritises accessibility over profit, aligning with the Olympic spirit of unity and global participation. On the eve of the Paris 2024 opening ceremony, out of 10 million tickets offered, more than one million remained unsold. While potentially limiting immediate revenue gains, this approach has likely contributed to the long-term strength of Olympics brand through greater opportunity for fans to interact and familiarise themselves with the brand.

Brand Finance data indicates a continued upward trajectory for the strength and value of the Olympics brand. It is likely additional revenue, sponsorship, and brand value records will be broken at the Los Angeles Games in 2028.