View the full Brand Finance Global 500 2021 report here

Apple has overtaken Amazon and Googleto reclaim the title of the world’s most valuable brand for the first time since 2016, according to the latest report by Brand Finance – the world’s leading brand valuation consultancy. Apple has the success of its diversification strategy to thank for an impressive 87% brand value increase to US$263.4 billion and its position at the top of the Brand Finance Global 500 2021 ranking.

Under Tim Cook’s leadership, especially over the past five years, Apple began to focus on developing its growth strategies above and beyond the iPhone – which in 2020 accounted for half of sales versus two-thirds in 2015. The diversification policy has seen the brand expand into digital and subscription services, including the App Store, iCloud, Apple Podcasts, Apple Music, Apple TV, and Apple Arcade. On New Year’s Day alone, App Store customers spent US$540 million on digital goods and services.

Apple’s transformation and ability to reinvent itself time and time again is setting it apart from other hardware makers and has contributed to the brand becoming the first US company to reach a US$2 trillion market cap in August 2020. With rumours resurfacing that Apple’s hotly anticipated Titan electric vehicle foray is underway again, it seems that there is no limit to what the brand can turn its hand to.

David Haigh, CEO of Brand Finance, commented:

“Steve Jobs’ legacy continues to flow through Apple, with innovation built into the brand’s DNA. As Apple reclaims the title of the world’s most valuable brand from Amazon five years since it last held the top spot, we are witnessing it Think Different once again. From Mac to iPod, to iPhone, to iPad, to Apple Watch, to subscription services, to infinity and beyond.”

South Africa just misses top 500

Africa continues to have no brands in the ranking, with its most valuable brand, South Africa’s telco giant, MTN, stubbornly remaining just outside the top 500. The absence of strong local brands on the continent provides rich pickings for the global giants as they dominate markets.

Technology drives brand value

In a year epitomised by global lockdowns, with working from home becoming the new normal and an unprecedented reliance on digital communication, retail, and entertainment, tech brands and brands successfully leveraging technological innovation have significantly boosted their brand values. Accounting for 14% of total brand value in the 2021 ranking, tech remains the most valuable sector in the Brand Finance Global 500, with 47 brands represented and a combined brand value just shy of US$1 trillion at US$998.9 billion.

Aided by the increased demand for home deliveries and safe means of travel during the pandemic, Uber has seen a 34% brand value jump to US$20.5 billion and entered the top 100 at 82nd. Similarly, Meituan, China’s largest provider of on-demand online services has gone up by an impressive 62% to US$7.2 billion, resulting in one of the biggest hikes up the ranking, as it jumped 216 spots to 265th.

Similarly, software providers such as Microsoft (up 20% to US$140.4 billion), SAP (up 9% to US$18.0 billion), Salesforce (up 29% to US$13.2 billion), Adobe (up 25% to US$11.7 billion), and a new entrant to the ranking, Servicenow (up 39% to US$4.3 billion), all enjoyed a boost in brand value as businesses raced to transition online and offices gave way to remote working for the greater part of last year.

David Haigh, CEO of Brand Finance, commented:

“With the onset of the pandemic, tech brands have experienced unprecedented demand for their products and services. At the same time, across sectors, brands which have pushed the boundaries of technological innovation have remained a cut above the rest, able to pivot their business to adapt to consumers’ changing needs. 2021 is the final call to get on board for all brands still stuck in the 20th century.”

Tesla races up ranking

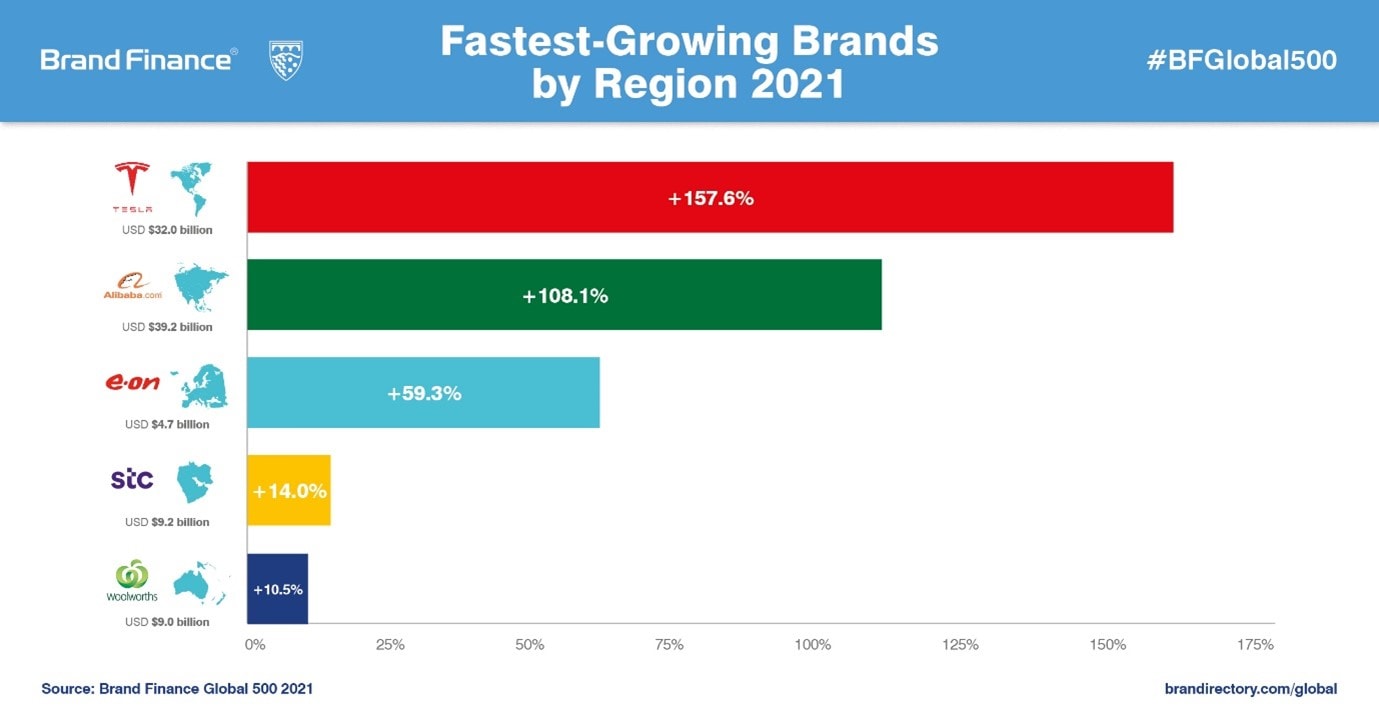

The importance of technological innovation as a driving force behind brand value is best exemplified by Tesla (up 158% to US$32.0 billion), the fastest-growing brand in the Brand Finance Global 500 2021 ranking. Emerging unscathed from the various controversies surrounding CEO, Elon Musk, Tesla’s market capitalisation has grown by an eyewatering US$500 billion over the last year, making it worth as much as the nine largest automobile manufacturers in the world combined.

The California-headquartered auto brand has also celebrated record numbers of sales this year, ramping up production of its Model Y car and expanding into new markets by opening a plant in Shanghai. As the world’s best-selling plug-in and battery electric passenger car manufacturer as well as a pioneer in using artificial intelligence in the automobile industry, Tesla has continued to strive for innovation and sustainability, developing more efficient battery cells.

Digital media stream on

Yet again demonstrating the importance of future-proofing brands by going digital, gaming and streaming services enjoyed a significant boost in brand value this year as users turned to online means of entertainment in the wake of the pandemic. Netflix enjoyed a spike in usage, causing its brand value to increase by 9% to US$24.9 billion. With 37 million new users by the end of 2020, Netflix’s success has driven improved revenue forecasts and brand equity scores. Despite this, the streaming platform’s growth was not as substantial as in previous years due to challenges posed by competitors such as Disney (down 9% to US$51.2 billion) and new entrant HBO (down 3% to US$4.0 billion).

In line with positive trends in brand value in the new media sector, Spotify entered the ranking for the first time, enjoying an impressive 39% boost in brand value to US$5.6 billion. The last year has seen a significant increase in new users as the music streaming platform expanded its operations into 13 new markets.

Another new entrant to the ranking, Electronic Arts (up 14% to US$4.4 billion), enjoyed a similar boost in revenue forecasts as many consumers turned to gaming to pass the time during lockdown. The brand is poised to continue this trajectory in the coming year, renewing its 10-year partnership with La Liga to retain the rights to its exclusive video game. Two other gaming giants, Tencent and Activision Blizzard saw even larger brand value boosts, up 28% to US$56.4 billion and up 20% to US$6.3 billion.

Unlike its new media counterparts, COVID-19 has exacerbated the issues faced by traditional media brands – including NBC (down 44% to US$8.4 billion), 20th Television (down 25% to US$6.1 billion), and Universal (down 21% to US$11.6 billion) – as production was halted and advertising budgets cut. The hardest hit is CBS – the fastest-falling brand in the Brand Finance Global 500 ranking this year. The network’s brand value has dropped by 49% to US$5.9 billion following a fall in advertising revenue and a disastrous merger with Viacom.

Long haul problems for aviation

A clear impact of the COVID-19 pandemic, aerospace and airline brands account for six out of the ten fastest-falling brands in this year’s Brand Finance Global 500, including Boeing (down 40% to US$13.6 billion), American Airlines (down 40% to US$5.3 billion), United Airlines (down 39% to US$5.0 billion), Delta (down 38% to US$5.8 billion), Airbus (down 36% to US$9.1 billion), and Safran (down 32% to US$4.3 billion).

Boeing’s woes continue as its brand value records yet another dent. The brand has spent much of the last two years in a state of crisis following the two fatal crashes that grounded its 737 Max in March 2019 and its problems have compounded further throughout the pandemic. With the partial return of the plane to operations in December 2020, the brand was hoping for a turbulence-free future to counter its significant losses and job cuts. However, as the brand hit the headlines once again with its 737-500 passenger plane crashing in Indonesia at the beginning of this year, it may not be the end of Boeing’s troubles.

David Haigh, CEO of Brand Finance, commented:

“Few sectors have been as deeply affected by the pandemic as the aviation industries. These brands are no stranger to rough patches, from the 2001 terror attacks and the 2008 financial crisis, to more recently the growing spotlight on their contribution to the climate crisis. The road to recovery and hopes are pinned on the speedy and successful roll out of the vaccines to open borders and kick-start the global economy once again.”

Hotels check out of top 500

As holidays are cancelled and people are instructed to work from home, the hospitality sector has reached an almost complete standstill both from tourism, as well as corporate travel. The world’s most valuable hotel brand, Hilton,has seen a 30% drop in brand value to US$7.6 billion. While Hilton’s revenue has taken a significant hit since the outbreak of the pandemic, the brand is showing confidence in its growth strategy, announcing a further 17,400 rooms to its pipeline, bringing the total to over 400,000 new rooms planned – an uplift of 8% on the previous year. Hilton’s rival, Marriott, has dropped out of the ranking this year, after losing more than half of its brand value.

While hotels check out, online booking platforms are crashing too. Booking.com has recorded a 19% brand value loss to US$8.3 billion, simultaneously dropping 43 positions in the ranking from 177th to 220th. Airbnb is anotherdropout this year, after two-thirds of its brand value eroded.

Restaurants left hungry for growth

Another hospitality sector, the world’s largest fast food and cafe chains have borne the brunt of global lockdown initiatives, with closures destroying sales and social distancing measures changing the way in which customers dine for the foreseeable future. Global leaders in the sector, Starbucks (down 6% to US$38.4 billion), McDonald’s (down 10% to US$33.8 billion),and KFC (down 12% to US$15.1 billion),have all recorded brand value losses.

With consumer habits being forced to change towards delivery and collection, brands that are already set up to accommodate this under their operations have managed to shelter themselves somewhat from the damage of the pandemic. Domino’s Pizza for example, which operates purely on takeaway and collection,has recorded a healthy 7% brand value increase to US$6.1 billion.

WeChat overtakes Ferrari

Apart from calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Certified by ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 50,000 respondents in nearly 30 countries and across more than 20 sectors. According to these criteria, WeChat has usurped Ferrari to become the world’s strongest brand with a Brand Strength Index (BSI) score of 95.4 out of 100. The Chinese mobile app is one of merely 11 brands in the ranking to have been awarded the elite AAA+ brand strength rating.

Alongside revenue forecasts, brand strength is a crucial driver of brand value. As WeChat’s brand strength grew, its brand value also enjoyed a rapid boost, increasing by 25% to US$67.9 billion and jumping 9 spots on the ranking to enter the top 10 for the first time.

As one of China’s home-grown tech successes with very strong equity, WeChatenjoyed high scores in reputation and consideration among Chinese consumers, according to Brand Finance’s original market research. The brand has successfully implemented a broad and all-encompassing proposition, offering services from messaging and banking, to taxi services and online shopping – the all-in-one app has become essential to many users’ daily lives.

During the pandemic, WeChat ran several government-mandated health code apps to keep track of those travelling or in quarantine, providing access to real-time data on COVID-19, online consultations, and self-diagnosis services powered by artificial intelligence to over 300 million users.

Meet the world’s top Brand Guardians

This year’s top CEO in the Brand Finance Brand Guardianship Index is Mastercard’s Ajay Banga. Mr Banga announced his transition from CEO to executive chairman in 2020, rounding off a successful and decorated 10 years as CEO. Since taking the helm of Mastercard, Mr Banga has embraced technological innovation, ensuring the brand remained relevant despite a period of rapid change in financial services. Mr Banga also champions the idea of financial inclusion, and has leveraged his influence to build strategic partnerships with financial institutions worldwide to help fight poverty.

David Haigh, CEO of Brand Finance, commented:

“COVID-19 has presented perhaps the greatest challenge to all CEOs this year. Leaders have had to both protect the financial interests of shareholders and protect their people from the very real threat to health and life posed by the pandemic. It has required resolve and vision to safeguard - and in some cases grow - one of these leaders’ most important assets, their company’s brand.”

View the full Brand Finance Global 500 2021 report here

ENDS

Every year, Brand Finance puts 5,000 of the biggest brands to the test, evaluating their strength and quantifying their value, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s 500 most valuable brands are included in the Brand Finance Global 500 2021 report.

Join our virtual launch event The Role of Tech Brands in Driving Economic Growth, featuring Deloitte Global CEO, Punit Renjen, at 1400–1600 GMT on 26th January to learn more about the results of this year’s study.

The full Brand Finance Global 500 2021 and Brand Guardianship Index 2021 rankings, additional insights, charts, more information about the methodology, as well as definitions of key terms are available in the Brand Finance Global 500 2021 report.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Please see below for a full explanation of our methodology.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.