View the full Brand Finance Canada 100 2021 report here

Though Canada’s tech industry is still comparatively small compared to traditional sectors, it is the fastest-growing sector in the Brand Finance Canada 100 2021 ranking, with tech brands growing by 56% on average year-on-year.

Shopify more than doubled in brand value to $828 million, making it the fastest-growing brand in the ranking. The brand was the most exciting new entrant to the ranking last year, and it has exceeded expectations after record-breaking growth. Shopify grew in brand value by 113%, jumping up 38 spots to rank 60th overall. Given its current growth trajectory, we expect Shopify to break into the 25 most valuable Canadian brands within the next three years.

Through multiple partnerships with large brands such as Pinterest, Facebook and the Libra Association, Shopify had its best year to date, announcing record breaking sales of $1.9 billion for Black Friday – a 75% increase on last year – and phenomenal e-commerce growth following the onset of the pandemic. On top of breaking sales records, Shopify has been highly investing in sustainable technologies and helping small businesses around the globe recover from COVID-19, including the launch of Shopify Capital to provide fast relief to cash-strapped businesses across the country.

While Shopify is the fastest-growing, Constellation Software (up 43% to $3.5billion) is the most valuable Canadian tech brand, jumping up eight spots to rank 24th overall. Alongside an active inorganic growth strategy, Constellation Software continues to excel and grow rapidly with its business model of managing and building vertical market software businesses.

Charlie Scarlett-Smith, Director, Brand Finance Canada, commented:

“With the onset of the pandemic, tech brands have experienced unprecedented demand for their products and services. At the same time, across sectors, brands which have pushed the boundaries of technological innovation have remained a cut above the rest, able to pivot their business to adapt to consumers’ changing needs. 2021 is the final call to get on board for all brands still stuck in the 20th century.”

Canadian banking sector marks decade-long lead in ranking

Stable, trustworthy, and internationally reputable financial services are the heart of the Canadian economy. Each year the ranking’s Top 10 is dominated by financial services brands. Although the Canadian banking sector declined by 52% year-on-year, the sector ranks 3rd in overall brand value globally – behind China and the United States. Financial services are also the leading industry in the Brand Finance Canada 100 2021 ranking for the 10th consecutive year, with a cumulative $93.6 billion in brand value - making up nearly 35% of the ranking's overall brand value.

Banking remains a consistently key economic driver for the country, even in the face of COVID-related global financial uncertainty. Additionally, Canadian banks have pledged an industry-wide commitment to environmental sustainability, dedicated to achieving a net-zero economy by 2050.

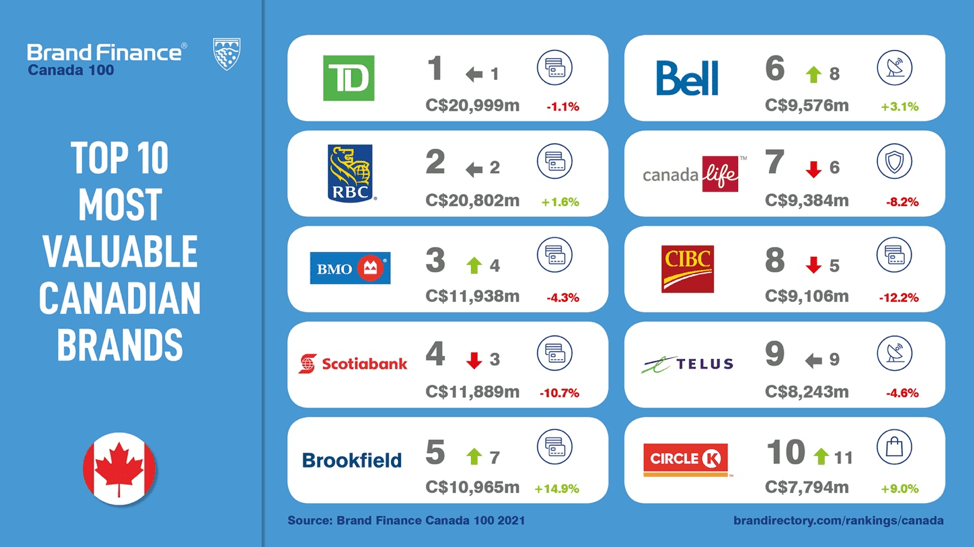

TD (down 1% to $21.0 billion) maintains its lead as most valuable Canadian brand after reclaiming the title last year from second-ranked RBC (up 2% to $20.8 billion). While TD’s overall performance is impressive given the hostile economic conditions brought on by the pandemic, marginal brand value growth from RBC has seen the gap between the two competitors close to just $197 million. Third and fourth place in the Brand Finance Canada 100 2021 ranking also go to banking brands for the third year running, with BMO (down 4% to $11.9 billion) in 3rd, and Scotiabank (down 11% to $11.9 billion)in 4th.

Circle K re-enters top 10 as rebranding efforts continue

Circle K re-enters the top 10 Canadian most valuable brands with a brand value of $7.9 billion and remains Canada’s most valuable retail brand. The most popular brand of Alimentation Couche-Tard's portfolio experienced a growth of 9% over the past year and will be replacing existing Statoil, Mac’s and Kangaroo Express’ branding on stores and service stations around Canada, the USA, Scandinavia and Europe. Circle K also jumped 4.1 points on its Brand Strength Index (BSI) to 57.6 out of 100. While this is sign that the new Circle K mono-brand is taking hold with customers, 57.6 is still a relatively low Brand Strength Index (BSI) score for a B2C brand. We will likely see this number increase as the new Circle K mono-brand starts to set its roots in deeper and becomes a more prominent figure in the fabric of public facing brands.

Long-haul problems for aviation

Canada’s airlines, Air Canada (down 42% to $2.9 billion) and West Jet (down 39% to $594 million) have dropped significantly in this year’s ranking, falling from 19th to 27th and 58th to 73rd respectively. Following several years of record growth, Air Canada's passenger numbers fell by 73% in 2020 as the pandemic sapped demand for air travel.

After announcing a $1.5 billion loss for Q4 2020 – in what Air Canada’s chief executive called the ‘bleakest year in aviation history’ – the airline’s $238 million purchase of Transat A.T. is a hopeful move towards a slow recovery. West Jet, however, views the deal as unfair competition for the industry, with West Jet CEO stating that ‘when Canadians look to explore the world and reunite with family and friends once again, they will face fewer choices and higher fares.

David Haigh, CEO of Brand Finance, commented:

“Few sectors have been as deeply affected by the pandemic as the aviation industries. These brands are no stranger to rough patches, from the 2001 terror attacks and the 2008 financial crisis, to more recently the growing spotlight on their contribution to the climate crisis. The road to recovery and hopes are pinned on the speedy and successful roll out of the vaccines to open borders and kick-start the global economy once again.”

Crown Royal defends its purple throne

Crown Royal (down 9% to $2.1 billion)maintains its title as Canada’s strongest brand for a second consecutive year with a Brand Strength Index (BSI) score of 85.8 out of 100. Crown Royal is also one of the only two Canadian brands to achieve a AAA brand rating, the other being RBC with a Brand Strength Index (BSI) score of 85.5 out of 100.

The Brand Strength Index (BSI) is a scorecard which benchmarks the relative strength of a brand against its competitors. The scorecard is populated by brand strength attributes relevant to the sector/industry. Among others, these key measures include: brand investment levels, awareness, familiarity, consideration, staff satisfaction, and corporate reputation. These are familiar measures to brand specialists and are a key component of our brand valuation methodology.

Crown Royal had already experienced supply shortages prior to the pandemic, and with more truck drivers unable to cross borders while also opting to stay at home for safety reasons, demand outweighed supply capacity leading to reduced sales and a drop-in brand value, despite its favorable Brand Strength rating.

Insurance brands drop out of top 10 strongest

Seven insurance brands feature in the Brand Finance Canada 100 2021 report, comprising 11% of the ranking’s total brand value. The most valuable of these is Canada Life ($9.4 billion), ranking 7th overall despite experiencing an 8% dip in brand value due to COVID-related factors, such as higher risk and lower long-term growth prospects.

The strongest insurance brand in the ranking is Sun Life, with a Brand Strength Index (BSI) score of 76.6 out of 100, dropping from last year’s AAA- rating to and AA+. This means that no insurance brands rank in the nation’s top ten strongest brands for 2021. Sun Life’s decrease in Brand Strength is due to weaker consumer research scores for familiarity, recommendation, and loyalty. On a positive note, Sun Life was rated in the research as the most ‘accessible anytime & anywhere’ – the metric shown to drive brand consideration most among Canadian consumers.

The next most important attributes for an insurance brand in the market are great customer service – top brand Intact at $2.1 billion – and good range of products – top brand Manulife at $6.7 billion. This shows how the most valuable brands are also those that create perceptions of consumer-centric decision-making processes. As we head towards a post-pandemic society, insurance brands will need to position themselves intelligently to appeal to consumers emerging in a world with new risks and shifting consumer priorities.

O&G brands face close to 20% average decline in brand value

The Canadian oil and gas (O&G) industry has had a dramatic year, with O&G brands dropping in brand value by an average 18%. Ten out of the seventeen Albertan brands in the Brand Finance Canada 100 2021 ranking are from the O&G sector, with fastest-falling Petro-Canada (down 35% to $1.,6 billion million) and Cenovus (down 32% to $1.,1 billion) naturally hit hard by historical lows in O&G prices due to decreased demand, as well as oil production conflicts between Saudi Aribia and Russia.

Canadian O&G brands were forced to cut production and human resources leading to a reduction in brand value across the board, save for TC Energy which remained stagnant at $1.5 billion. Alberta has the third-largest crude oil reserves in the world with 166.3 million barrels in Alberta alone, meaning the next few years will be crucial for O&G and the economy.

View the full Brand Finance Canada 100 2021 report here

ENDS

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.