View the full Brand Finance Global 500 2021 report here

David Haigh, CEO of Brand Finance, commented:

“As the UAE approaches its 50th anniversary in December, the nation continues to flourish and showcase its accomplishments in undertaking an impressive growth trajectory, under the visionary leadership of Sheikh Khalifa bin Zayed Al Nahyan, Sheikh Mohammed bin Rashid Al Maktoum and Sheikh Mohammed bin Zayed Al Nahyan. The nation’s world-class brands are helping spearhead global transformation across their respective industries – from ADNOC’s innovation in sustainability, Etisalat’s accomplishment becoming the fastest network globally, DP World’s position as a leader in logistics to Emirates flying the flag – quite literally – the world over. Recent events have truly demonstrated the nation’s position on the global stage, from its efforts in the face of the pandemic, including international aid to vaccine development, to the historic peace deal with Israel - the UAE is demonstrating that it is a force to be reckoned with. We have seen the transformation from desert to Mars – what will the next 50 years hold?”

Oil & gas brands lead the way

Saudi Aramco retains its position as the region’s most valuable brand in the Brand Finance Global 500 2021 report, despite recording a 20% brand value loss to US$37.5 billion. Owing to the sheer size and scale of the business, as well as its low costs of production, Saudi Aramco has been in a stronger position to negotiate the fallout from the pandemic than many of its counterparts, but still suffered a significant hit to profits.

While brand value has fallen, Aramco’s brand strength has remained stable. Other intangibles such as relationships, particularly with the Saudi Arabian government, play a greater role in performance.

David Haigh, CEO of Brand Finance, commented:

“Aramco is the hidden giant of the oil industry whose brand has finally emerged into the light of public attention. It has always been known as a b2b brand but has aspirations to become a well-known consumer brand. At present its scale is huge but its brand equity is at an early stage of development. We believe that over the next decade the brand will grow from strength to strength as it enters the world stage.”

Fellow Oil & Gas brand the Abu Dhabi National Oil Company (ADNOC) is the second most valuable brand across the region. ADNOC has managed to successfully shelter its brand value during an incredibly challenging year for its industry, with only a 6% brand value loss to US$10.8 billion, making it the most resilient of all National Oil Companies (NOC) globally.

ADNOC’s transformation since 2016 has taken the brand from strength to strength. Under the astute leadership of Group CEO H.E. Dr. Sultan Ahmed Al Jaber, ADNOC has evolved into a trusted global player with one brand and one strategic vision at its core. It has attracted some of the world’s leading institutional investors as partners across its business and has raised more than US$64 billion through such transactions since the start of its transformation. Due to ADNOC’s competitive advantage in cost and carbon efficiency per barrel of oil produced, it is a likely contender to be “the last barrel standing” in the ongoing transition to a low carbon economy.

ADNOC is actively investing in diversifying its portfolio beyond raw commodity exports with recently announced efforts in hydrogen, ammonia and other value-add Downstream products – part of the brand’s longstanding commitment to future proofing its economic contributions to the UAE and maintaining a legacy of environmental stewardship. To date, the Group has invested in a number of measures to reduce its carbon footprint, notably through a significant expansion of carbon, capture and storage (CCS) technology across its business.

ADNOC once again is set to raise the profile of Abu Dhabi and the GCC through the launch of the highly anticipated futures exchange for Murban crude.

David Haigh, CEO of Brand Finance commented:

“ADNOC has been the principal enabler of the UAE and Abu Dhabi success story since its inception just under 50 years ago. Since taking the helm, Group CEO H.E. Dr. Sultan Ahmed Al Jaber has successfully transformed the company into a leaner, more efficient and internationally competitive energy producer. Today, ADNOC plays a critical role driving local industry growth, supporting Abu Dhabi’s soft power position globally and advancing the UAE’s sustainable economic development goals. ADNOC’s enduring brand strength reflects the strength of its reputation as an industry leader in both cost and carbon efficient oil production, a critical driver of innovation and technology in the UAE and a partner of choice for local and international investors.”

Etisalat is region’s strongest brand

In addition to measuring overall brand value, Brand Finance also evaluates the relative strength of brands, based on factors such as marketing investment, customer perceptions, staff satisfaction, and corporate reputation. Alongside revenue forecasts, brand strength is a crucial driver of brand value. According to these criteria, Etisalat has been crowned Middle East’s strongest brand for the first time, overtaking Emirates Airlines, with a Brand Strength Index (BSI) score of 87.4 out of 100 and a corresponding AAA brand strength rating – the only brand in the region to achieve this rating. This increase puts Etisalat among the top 25 brands globally for BSI.

Thanks to its strategy over the last few years and its recent achievement of becoming the fastest network on the planet, the brand was in a position to respond immediately to the 'new normal' of the pandemic, providing solutions and flexibility in a way that connected emotionally with consumers. Under the guidance of its dynamic new Group CEO, Hatem Dowidar, Etisalat Group, is turning its sights on transforming into a truly global player. Etisalat has also climbed 17 spots in the brand value ranking this year, from 225th to 208th.

David Haigh, CEO of Brand Finance commented:

“When COVID struck in 2020, Etisalat led from the front ensuring business continuity, robust e-governance, enablement of smart cities and remote learning, to help drive the digital future of the UAE. Staying relevant and enabling the nation with the fastest network on the planet, Etisalat has earned its place as the region’s Strongest Brand, ready deliver on its ethos of Together Matters as the UAE welcomes the world at Expo 2021.”

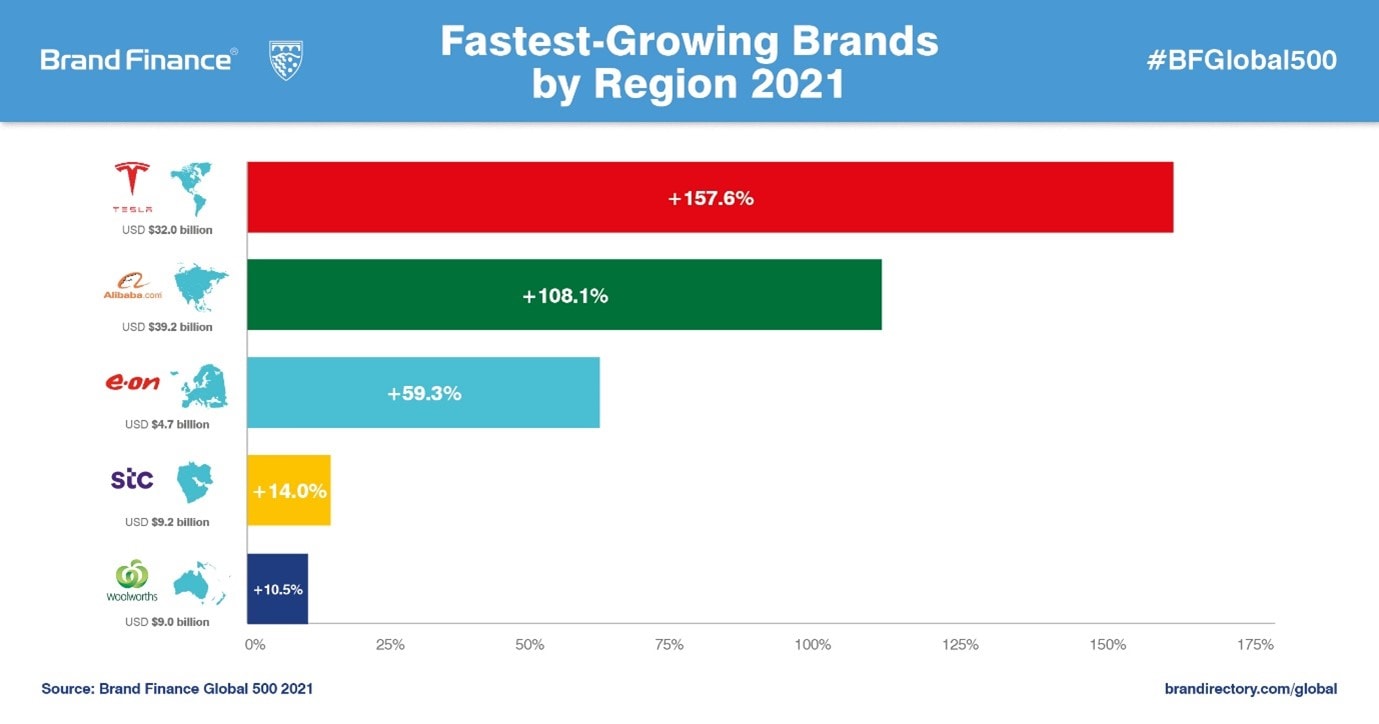

stc is the region’s fastest growing brand, up an impressive 14% to US$9.2 billion and simultaneously jumping 53 positions to 189th. stc has recently doubled the capacity of its network, never compromising on customer service – something the brand prides itself on. The brand has also achieved a AAA- brand rating for the first time because of its brand and business transformation.

David Haigh, CEO of Brand Finance commented:

“stc’s brand has evolved and grown following its successful masterbrand refresh and extension into Kuwait and Bahrain at the beginning of last year. The company continues to execute its DARE strategy successfully and has strengthened its positioning as a company that enables digital life. Its commitment to digital transformation has been shown with stc pay, recognised as the first tech unicorn in Saudi Arabia.”

Apple is named world’s most valuable brand

Apple has overtaken Amazon and Googleto reclaim the title of the world’s most valuable brand for the first time since 2016, according to the latest report by Brand Finance – the world’s leading brand valuation consultancy. Apple has the success of its diversification strategy to thank for an impressive 87% brand value increase to US$263.4 billion and its position at the top of the Brand Finance Global 500 2021 ranking.

Under Tim Cook’s leadership, especially over the past five years, Apple began to focus on developing its growth strategies above and beyond the iPhone – which in 2020 accounted for half of sales versus two-thirds in 2015. The diversification policy has seen the brand expand into digital and subscription services, including the App Store, iCloud, Apple Podcasts, Apple Music, Apple TV, and Apple Arcade. On New Year’s Day alone, App Store customers spent US$540 million on digital goods and services.

Apple’s transformation and ability to reinvent itself time and time again is setting it apart from other hardware makers and has contributed to the brand becoming the first US company to reach a US$2 trillion market cap in August 2020. With rumours resurfacing that Apple’s hotly anticipated Titan electric vehicle foray is underway again, it seems that there is no limit to what the brand can turn its hand to.

David Haigh, CEO of Brand Finance, commented:

“Steve Jobs’ legacy continues to flow through Apple, with innovation built into the brand’s DNA. As Apple reclaims the title of the world’s most valuable brand from Amazon five years since it last held the top spot, we are witnessing it Think Different once again. From Mac to iPod, to iPhone, to iPad, to Apple Watch, to subscription services, to infinity and beyond.”

Amazon thrives in 2020

Despite relinquishing its position at the top, second-ranked Amazon has still managed to record a healthy 15% brand value growth to US$254.2 billion. The retail giant is one of the few brands that benefitted considerably from the pandemic and the resulting unprecedented surge in demand as consumers turned online following store closures. Over Q2 and Q3 of 2020, e-commerce platforms experienced the highest revenue growth since 2016.

Most recently – further leveraging the circumstances of the pandemic – Amazon has acquired 11 passenger planes from struggling North American airlines to expand its air logistics capabilities. A tactical purchase to support its fast-growing customer base, but also a strategic move towards building its own end-to-end supply chain, the fleet can allow the brand to become a serious contender in air transportation in due time.

Another example of Amazon’s relentless innovation in the face of global adversity, the brand has also announced its foray into the health sector with the launch of Amazon Pharmacy and fitness tracker Halo. Before it brought success to Apple, daring diversification had already been the hallmark of Amazon’s growth strategy, which it continues to pursue with impressive results.

David Haigh, CEO of Brand Finance, commented:

“Playing a crucial role in supporting a new economic mode in lockdown, Amazon has found itself at the centre of attention more than ever before. With a revenue boost came reputational risks – from questions about the treatment of workers, to accusations of benefitting from the tragedy of the pandemic, to pushback against a global corporation in support of local retailers. Jeff Bezos has a difficult task at hand to steer the Amazon brand through dangerous waters.”

Technology drives brand value

In a year epitomised by global lockdowns, with working from home becoming the new normal and an unprecedented reliance on digital communication, retail, and entertainment, tech brands and brands successfully leveraging technological innovation have significantly boosted their brand values. Accounting for 14% of total brand value in the 2021 ranking, tech remains the most valuable sector in the Brand Finance Global 500, with 47 brands represented and a combined brand value just shy of US$1 trillion at US$998.9 billion.

Aided by the increased demand for home deliveries and safe means of travel during the pandemic, Uber has seen a 34% brand value jump to US$20.5 billion and entered the top 100 at 82nd. Similarly, Meituan, China’s largest provider of on-demand online services has gone up by an impressive 62% to US$7.2 billion, resulting in one of the biggest hikes up the ranking, as it jumped 216 spots to 265th.

Similarly, software providers such as Microsoft (up 20% to US$140.4 billion), SAP (up 9% to US$18.0 billion), Salesforce (up 29% to US$13.2 billion), Adobe (up 25% to US$11.7 billion), and a new entrant to the ranking, Servicenow (up 39% to US$4.3 billion), all enjoyed a boost in brand value as businesses raced to transition online and offices gave way to remote working for the greater part of last year.

David Haigh, CEO of Brand Finance, commented:

“With the onset of the pandemic, tech brands have experienced unprecedented demand for their products and services. At the same time, across sectors, brands which have pushed the boundaries of technological innovation have remained a cut above the rest, able to pivot their business to adapt to consumers’ changing needs. 2021 is the final call to get on board for all brands still stuck in the 20th century.”

WeChat overtakes Ferrari

Apart from calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Certified by ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 50,000 respondents in nearly 30 countries and across more than 20 sectors. According to these criteria, WeChat has usurped Ferrari to become the world’s strongest brand with a Brand Strength Index (BSI) score of 95.4 out of 100. The Chinese mobile app is one of merely 11 brands in the ranking to have been awarded the elite AAA+ brand strength rating.

Alongside revenue forecasts, brand strength is a crucial driver of brand value. As WeChat’s brand strength grew, its brand value also enjoyed a rapid boost, increasing by 25% to US$67.9 billion and jumping 9 spots on the ranking to enter the top 10 for the first time.

As one of China’s home-grown tech successes with very strong equity, WeChatenjoyed high scores in reputation and consideration among Chinese consumers, according to Brand Finance’s original market research. The brand has successfully implemented a broad and all-encompassing proposition, offering services from messaging and banking, to taxi services and online shopping – the all-in-one app has become essential to many users’ daily lives.

Meet the world’s top Brand Guardians

This year’s top CEO in the Brand Finance Brand Guardianship Index is Mastercard’s Ajay Banga. Mr Banga announced his transition from CEO to executive chairman in 2020, rounding off a successful and decorated 10 years as CEO. Since taking the helm of Mastercard, Mr Banga has embraced technological innovation, ensuring the brand remained relevant despite a period of rapid change in financial services. Mr Banga also champions the idea of financial inclusion, and has leveraged his influence to build strategic partnerships with financial institutions worldwide to help fight poverty.

David Haigh, CEO of Brand Finance, commented:

“COVID-19 has presented perhaps the greatest challenge to all CEOs this year. Leaders have had to both protect the financial interests of shareholders and protect their people from the very real threat to health and life posed by the pandemic. It has required resolve and vision to safeguard - and in some cases grow - one of these leaders’ most important assets, their company’s brand.”

View the full Brand Finance Global 500 2021 report here

ENDS

Every year, Brand Finance puts 5,000 of the biggest brands to the test, evaluating their strength and quantifying their value, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s 500 most valuable brands are included in the Brand Finance Global 500 2021 report.

Join our virtual launch event The Role of Tech Brands in Driving Economic Growth, featuring Deloitte Global CEO, Punit Renjen, at 1400–1600 GMT on 26th January to learn more about the results of this year’s study.

The full Brand Finance Global 500 2021 and Brand Guardianship Index 2021 rankings, additional insights, charts, more information about the methodology, as well as definitions of key terms are available in the Brand Finance Global 500 2021 report.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Please see below for a full explanation of our methodology.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.