View the full Brand Finance Banking 500 2022 report here

The world’s top 500 banking brands have turned the tide on brand value contraction for the first time in three years, observing a 9% year-on-year brand value growth to reach an all-time high of US$1.38 trillion, according to the latest report by Brand Finance published in The Banker magazine today.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s top 500 most valuable and strongest banking brands are included in the annual Brand Finance Banking 500 ranking.

The brand value of the world’s largest banks shrunk by 2% by the beginning of 2020 (US$1.33 trillion) and a further 4% by 2021 (US$1.27 trillion). Initially caused by economic uncertainty and interest rate movements, the situation was exacerbated by the pandemic, which saw profit and interest rates take a hit.

However, as nations continued to adapt to COVID-19 and economies rebounded over the past year, loan loss provisions were much less significant than initially forecasted by industry experts. Furthermore, improved digitalization by banking brands, coupled with a strong government intervention and economic recovery around the world resulted in a higher than expected industry profitability in 2021.

While this year’s overall brand value growth is undoubtedly a positive sign for the industry, it signifies a meagre 2% increase from US$1.36 trillion, which was the combined pre-pandemic brand value of the world’s top 500 banking brands in 2019. Particularly in Europe, banks are still feeling the effects of COVID-19, where weak profits are not helped by cost inefficiency and insufficient investments in digital technology.

David Haigh, Chairman & CEO of Brand Finance, commented:

“As banks continue to battle the fallout from the COVID-19 pandemic, the importance of a solid brand is more significant than ever. Banking products are becoming more commoditized, and banks will need to continue differentiating themselves from other competitors in the market, through the use of their brand, particularly in the face of an emerging threat from challenger brands and decentralized finance in the future.”

“Many of the world’s largest banking brands have come through the worst of the pandemic stronger – a testament to the role they have played in supporting the real economy through the past 12 months,” said Joy Macknight, editor of The Banker. “Banks’ digital transformation efforts over recent years meant they were able to respond faster to client needs, as well as deliver new products and services, which has boosted banks’ reputations in the eyes of their retail and corporate customers.”

US banks account for 5 spots in top 10

US banks account for almost a quarter of the total brand value in the Brand Finance Banking 500 2022 ranking, worth a cumulative brand value of US$313.7 billion. Of these 76 brands, Bank of America (up 12% to US$36.7 billion), Citi (up 7% to US$34.4 billion), Chase (up 5% to US$30.1 billion), Wells Fargo (down 6% to US$30.1 billion), and JP Morgan (up 23% to US$28.9 billion) have held on to their spots in the top 10 of the world’s most valuable.

In a significant move, Citi announced its withdrawal from all retail banking operations in Mexico in January 2022. Placing the brand and entire retail operation for sale, Citi intends to focus on businesses that benefit from connecting to its global network while allowing the bank to further simplify its business. However, questions remain regarding the future of the Banamex brand as well as the 1,500 retail branch network that handles over 20 million clients and approximately 15.5 million daily transactions.

Dropping one spot in the ranking to 8th position, Wells Fargo is the only bank in the top 10 with a contracting brand value. Wells Fargo continues to be undermined by the account fraud scandal, where it emerged that the bank had forged millions of savings and checking accounts on behalf of its clients without their consent. The scandal continued to bring about financial and legal consequences in 2021.

Chinese banks dominate ranking

Chinese banks maintain the lead in the Brand Finance Banking 500 2022 ranking, accounting for one third of total brand value and worth a cumulative US$454.4 billion. While their global counterparts saw drops in brand value over the past two years, Chinese banks remained largely impervious to these issues. A significant factor to this success was not only the nation’s timely response to the virus, but also the early and continued investment into digital development, allowing Chinese banks to continue engaging with their customers with relatively little disruption. Over the past year, China’s economy has continued to recover steadily despite a complex and ever-changing domestic and international environment. In the first half of 2021 alone, the nation’s GDP increased by 13% year-on-year.

The world’s largest bank by total assets, ICBC’s brand value has increased by 3% to US$75.1 billion, making it the world’s most valuable banking brand again as well as the 8th most valuable brand across all industries in the Brand Finance Global 500 2022 ranking. Over the past year, ICBC has continued to fare well with consumers and expand its portfolio, opening branches in foreign markets such as Mexico, Argentina, and most recently Panama. ICBC continues to outshine its competitors, holding a healthy brand value lead ahead of China Construction Bank (up 10% to US$65.5 billion)and Agricultural Bank of China (up 17% to US$62.0 billion), which rank 2nd and 3rd, respectively.

Declan Ahern, Valuation Director at Brand Finance, commented:

“Chinese banks have performed extraordinarily well this year, with no signs of growth slowing down for years to come. This was undoubtedly aided by the country’s timely response to the pandemic, which reduced the level of economic disruption observed by its counterparts in Europe and the United States.”

Regional leaders

Looking beyond North America and East Asia, HSBC (12th, up 6% to US$18.0 billion) is the most valuable banking brand in Europe,Singapore’s DBS (39th, up 11% to US$8.7 billion) leads the way in Southeast Asia, State Bank of India is number #1 in South Asia (43rd, up 29% to US$7.5 billion), QNB (45th, up 16% to US$7.1 billion) has consolidated its position as the most valuable banking brand in the Middle East, Itaú (51st, up 30% to US$6.6 billion) dominates in Latin America, and Standard Bank (145th, up 26% to US$1.6 billion) has claimed the title of the most valuable banking brand in Africa.

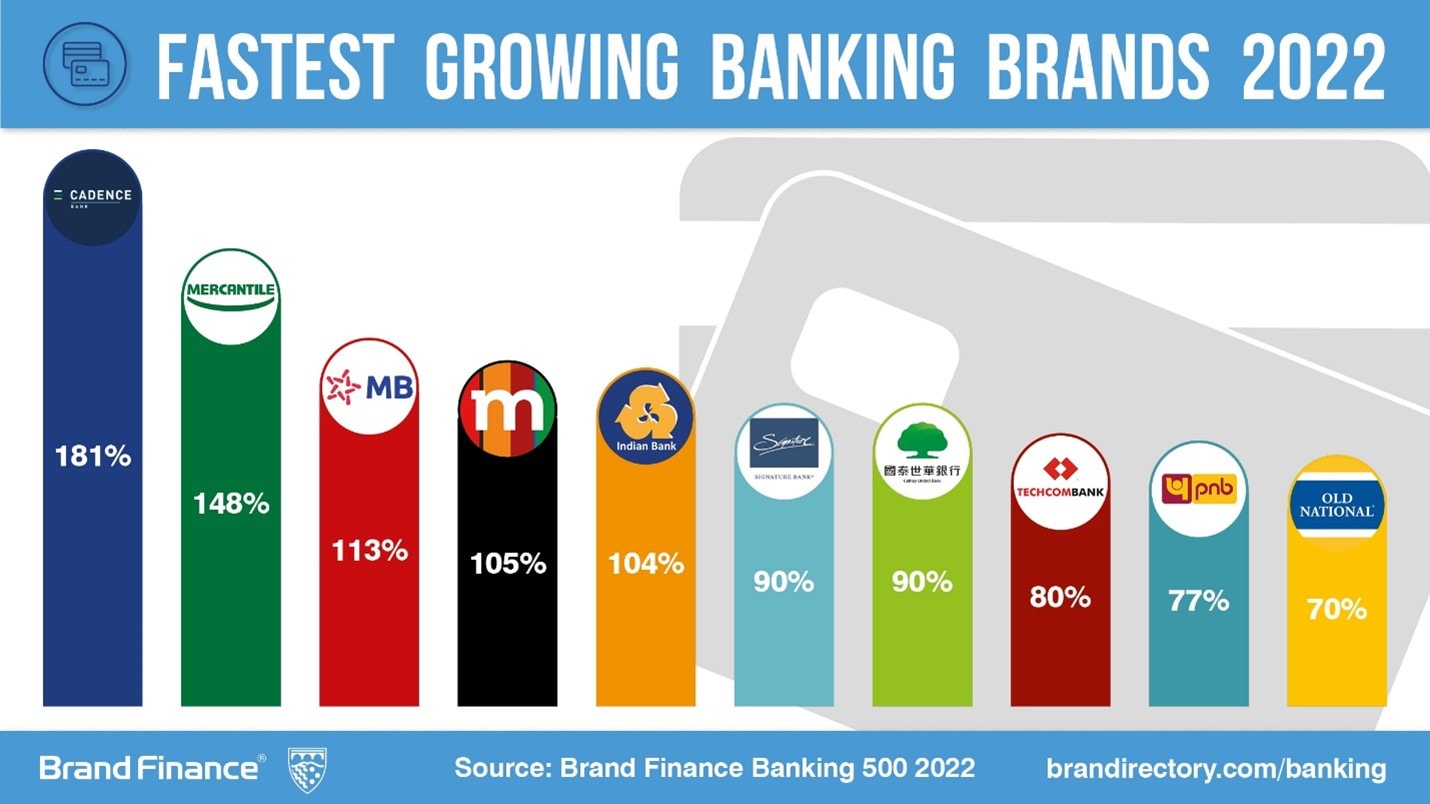

Cadence Bank world’s fastest-growing

30 newcomers have joined the Brand Finance Banking 500 2022 ranking this year, and although most hail from smaller and emerging markets, there are also six US banking brands in the contingent.

The most valuable among the new entrants from the US, Cadence Bank has entered the ranking as the fastest-growing brand of 2022 across all countries. With an eyewatering brand value increase of 181%, it has reached a valuation of US$403 million and claimed 329th rank among the top 500. The bank has recently entered into a merger agreement with BancorpSouth Bank, which held a brand value of US$266 million in the 2021 iteration of the Brand Finance Banking 500 ranking. As part of the agreement BancorpSouth has rebranded to Cadence Bank. The merger aims to provide more customer and relationship-focused financial services to Cadence Bank’s extensive customer base across the southern US.

Green Dot (399th), Columbia Bank (463rd), Bank of Hope (464th), Home Bancshares (487th), and Northwest Savings Bank (499th) are the remaining five new entrants from the US.

BCA as sector’s strongest

Apart from calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Certified by ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors.

According to these criteria, Indonesia’s BCA is the strongest bank in the Brand Finance Banking 500 2022 ranking, following a +2.5 point increase to reach a Brand Strength Index (BSI) score of 94.0 out of 100 and an elite AAA+ brand strength rating.

As one of the biggest banks in the ASEAN region and Indonesia’s largest lender by market value, BCA has performed strongly across key metrics, particularly those pertaining to customer satisfaction. In Brand Finance’s original market research, BCA outperformed its peers for reputation and quality, and scored highly for value for money.

Declan Ahern, Valuation Director at Brand Finance, commented:

“BCA’s performance is an excellent example of the importance of customer relationships in building brand loyalty and reputation. The brand has consistently scored favourably across brand strength metrics for the last few years, now reclaiming its spot as the strongest banking brand in the world.”

View the full Brand Finance Banking 500 2022 report here

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s top 500 most valuable and strongest banking brands are included in the annual Brand Finance Banking 500 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Banking 500 ranking.

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

About The Banker

The Banker provides economic and financial intelligence for the world's financial sector and has built a reputation for objective and incisive reporting. It leads the debate on all the issues surrounding the global banking industry, providing in-depth news and analysis, exclusive interviews with senior industry figures and definitive regional bank listings, including the internationally acclaimed Top 1000 World Banks ranking.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.