In the article "Risky Business: The Accounting Treatment of Goodwill", published in 2018, I commented on the widespread resistance to disclosing specific intangible assets. More commonly, excess value recognised on the acquisition of a subsidiary is lumped into the ambiguous intangible asset class, goodwill.

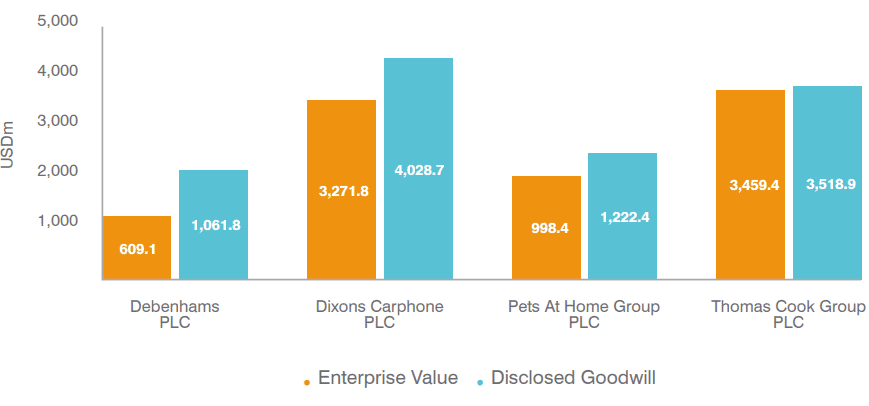

In the analysis, I noted the high booked goodwill versus total enterprise value for four major UK branded chains: Debenhams, Dixons Carphone, Pets at Home, and Thomas Cook Group.

So how did 2019 turn out for these 4 companies?

Debenhams

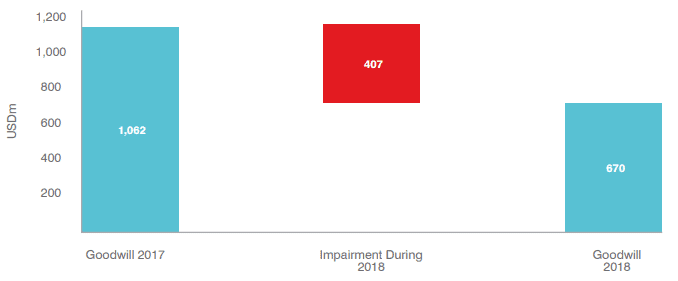

Shortly after the completion of the whitepaper analysis last year, Debenhams’ new finance director took a decisive impairment against goodwill of $407m, which contributed to heavy losses and cancellation of dividends.

Subsequently in 2019, Debenhams entered into a CVA. Some attribute Debenhams’ situation with a failure to adapt to a changing competitive landscape and falling consumer confidence. While high levels of goodwill were not the direct cause of Debenhams’ issues, the historic accounting treatment did not help the situation.

Goodwill is ambiguous and therefore challenging to interpret, without full knowledge of the model which underlies its calculation and annual impairment test. This provides further evidence supporting our view that specific intangible asset valuation should be conducted by independent experts, before and in the years after a significant acquisition.

Dixons Carphone

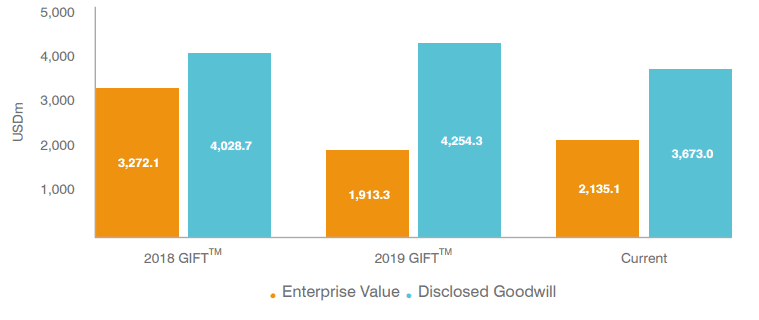

In the 2019 analysis, Dixons Carphone’s proportion of goodwill to enterprise value remained high, especially given that the latter fell further, by 42% year-on-year.

Subsequently to this year’s GIFT™ analysis, Dixons released their 2019 financial results. While goodwill is still in excess of enterprise value, an impairment of $294 m is reflected in the new goodwill figure. The impairment was caused by a higher discount rate applied in the impairment test valuation, reflecting higher uncertainty and challenges for the UK retail environment.

Pets at Home

A slightly different tale for Pets at Home; the group position has improved year on year, enterprise value has grown by 53%, and the company has repeatedly exceeded analyst expectations.

If such high goodwill was avoided in the first place, perhaps investors would have understood the future viability of the company, thus maintaining holdings and the share price. To improve transparency for analysts and for investors, expert intangible asset valuers should be consulted before, during, and following a transaction. Practitioners such as Brand Finance can help to advise and provide an opinion on the value of intangible assets under question, as well as recommendations on how to grow those asset values throughout the integration plan.

Thomas Cook

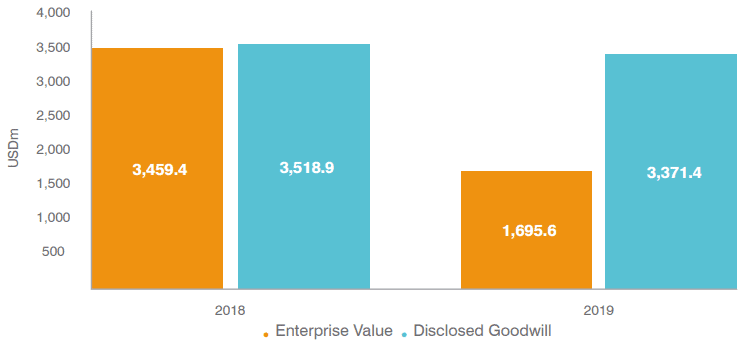

Having failed to gain sufficient backing for a £900m rescue deal, Thomas Cook collapsed in September 2019. As a result, 150,000 British holidaymakers were stranded overseas. In the aftermath, executive management came under scrutiny for the high salaries and £20m in bonuses over the past 5 years – despite indications of the company’s struggles.

When Brand Finance conducted this year’s GIFT™ analysis, right before the company collapsed, the last reported goodwill was just shy of two times the enterprise value. Ideally, Thomas Cook should have never recognised such a high value for goodwill. This goodwill value arose due to the series of acquisitions between 1993 and 2011. This value could have been allocated to other assets than goodwill, such as brand, technology, contractual value, or even customer relationship value.

At the beginning of 2019, Brand Finance valued the Thomas Cook brand at £836m. In early November, the Chinese conglomerate Fosun acquired the Thomas Cook trademarks, websites, social media accounts, and software across nearly all markets globally for only £11m.

The brand was undeniably troubled – even before the 2019 reputational damage, Thomas Cook faced existing competition from DIY holiday sites including Skyscanner, Airbnb, Booking.com, and Trivago. However, Thomas Cook is one of many British brands that have been scooped up for bargain prices because management don’t know their full worth.

Lessons

We all know that M&A is tricky, with many business combinations failing. To safeguard core assets, the first key step is to understand their value to the business, and how to support those assets.

Management needs to consult with independent, objective subject experts to determine the value of their intangible assets. This should be done pre-, during and post-acquisition.

This would help management to integrate a target company successfully. Specific intangible asset values, such as brand, should be considered through a legal, behavioural, and financial lens. This exercise forces the intangible assets to be objectively appraised, grounded in the reality of actual stakeholder perceptions and business performance.

By properly recognizing the value of specific intangibles, rather than lumping it all into goodwill, users of financial statements are able to better scrutinise the specific intangible assets expected to bring value to the business.

If deeper insight into the specific intangible assets acquired is offered to investors, there is a further case for intangible value disclosure. Currently, internally generated intangibles such as brand value cannot be capitalised and disclosed on the balance sheet. Ideally, all intangible assets, both acquired and internally generated, should be revalued every year, and boards should be required to disclose their view of those values.