This article was originally published in the Brand Finance City Index Report

London is crowned the best city brand in the world by the Brand Finance City Index 2023, thanks to its history, culture, and housing of major global brands.

At the same time, the City of London – the core financial district in the Greater London metropolis – is The City within the city. The City of London was initially established in Roman times, subsequently re-established later in the first millennium, and today is governed separately from Greater London, led by the locally elected Lord Mayor. The City of London is also home to Brand Finance headquarters at 3 Birchin Lane.

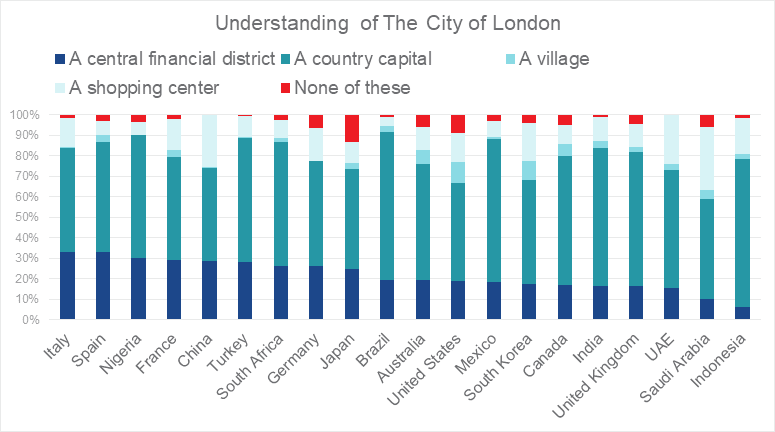

The Brand Finance City Index 2023 is informed by an original piece of general public research conducted by Brand Finance. In this research, we have measured sentiment towards major cities around the world, as places to work, live, study and visit. In addition, we asked all the respondents who are familiar with London what they think of when they think of “The City of London”. The vast majority get it wrong, assuming that the question is simply referring to London.

One of countries with the lowest familiarity with The City of London is the United Kingdom itself, with only 16% of the British public knowing what The City is. The best understanding of The City is seen in Italy and Spain: perhaps Italians are sympathetic with the nuance given the similarity between The City and Vatican City. Broadly, however, many people are unaware of the difference between Greater London and The City of London.

It’s time to recognise that while London as a whole has strong appeal, The City of London is not nearly as famous and therefore influential as insiders may think. This brand challenge is more concerning when we consider the significant value generated in, and traded through, The City of London. Like The City of London itself, most of the value generated within the square mile is not held in tangible assets, nor is it reported on. This leads to the natural concern about management and longevity of these assets.

Brand Finance recently had the pleasure to partner with Sheriff Andrew Marsden of the Corporation of The City of London, to research and discuss intangible asset value and The City with leaders of institutions and Livery companies in The City.

Click here to read more about Intangible Asset value online here

Every year, through our GIFT™ report, we estimate intangible value globally, based on capital markets. In the latest report, October 2022, we found that globally, intangible assets are worth $57.3 trillion. 70% of this value is estimated as the trading premium of companies versus their net book value. This means that the majority of this value is not recorded or reported in company accounts.

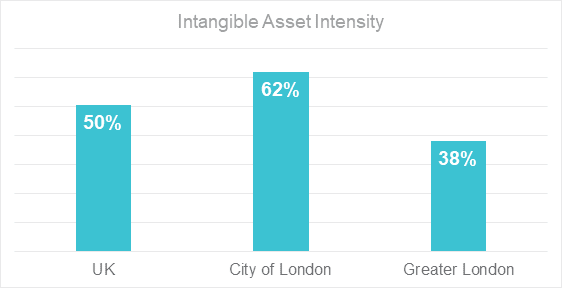

Updated analysis conducted last month found that over half of the UK’s intangible asset value is generated in London, with almost 1/3 of that generated within The City of London. While Greater London is approximately 40% intangible, The City of London is far more intangible, with 60% of total value estimated to be intangible assets rather than tangible.

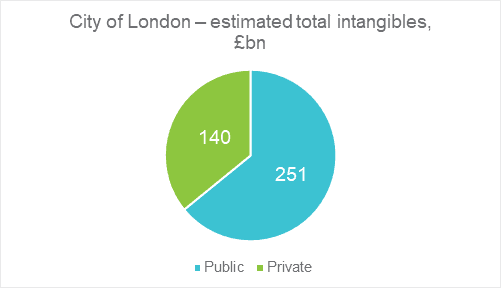

We extrapolated our analysis to estimate the intangible value of private companies too, based on headcount in The City. This analysis suggests that The City of London is home to an incredible £400 billion of intangible value.

Due to limited reporting of private companies and legacy accounting practices, only 12% of this value is publicly reported. In addition to the £400 billion housed in companies in The City, significantly more value is generated and traded through The City. And significantly more may be generated by The City Corporation itself. We regularly question whether such a low incidence of reporting leads to the likely conclusion that very little intangible assets get the attention, management, and investment they need. We continue to advocate for better disclosure of, management of, and investment in intangibles. The same advice is echoed by academics, industry practitioners, and expert institutions here in The City and around the World.