This article was originally published in the Brand Finance Global Most Valuable B2B Brands Index 2025

Valuation Director,

Brand Finance

No longer just the domain of industrial giants and faceless tech infrastructure, today’s most valuable and fastest-growing brands are increasingly those that sell to businesses, not consumers.

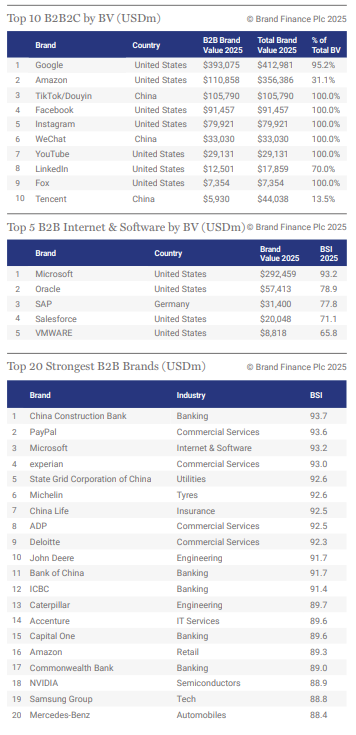

B2B companies vary greatly in terms of how they operate. Some brands focus purely on enterprise clients (B2B), others maintain a dual-facing strategy and offer products and services to both consumers and businesses, many operate in government procurement cycles (B2G), and a growing number of brands are B2B2C, where the product/service users are consumers, which business customers pay to access, as is the case for e-commerce or social media platforms.

To create value through brands in business-targeting sectors requires marketers to have a keen understanding of the stakeholders relevant to their business model. Each target audience comes with its own brand-building imperatives and in 2025, these distinctions matter more than ever. In the 2025 Brand Finance B2B 250 ranking, only 54% of the brands are pure-play B2B.

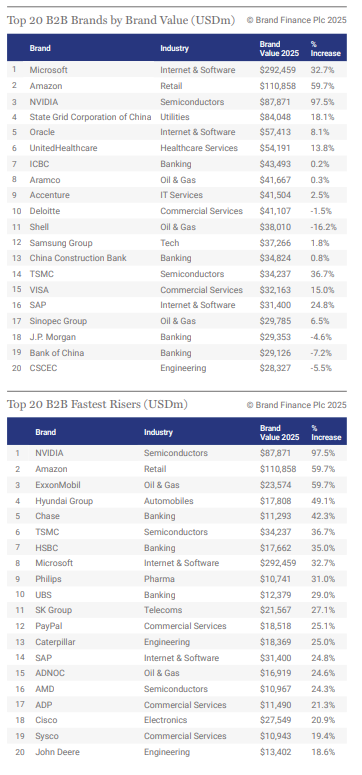

Semiconductor brands like NVIDIA, TSMC, and Intel thrive in traditional B2B environments, with brand strength built on performance, innovation, and technical leadership. For example, NVIDIA is the fastest growing for a second year in a row, with brand value doubling this year to become the 3rd most valuable B2B brand in 2025. However, while this is fast growth, the broader enterprise value growth has been even faster. As a result, NVIDIA’s brand value is 3.1% of its broader enterprise value this year, down from 3.9% of the enterprise value last year.

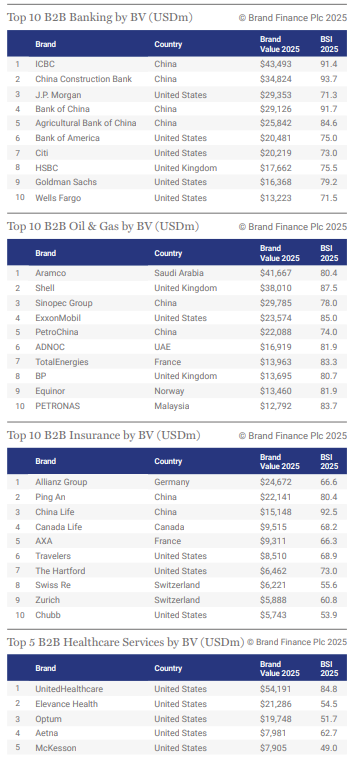

Tyre brands like Michelin, Bridgestone, and Goodyear sell through dealerships and OEMs but invest heavily in end-user visibility, demonstrating the power of B2B2C. Tech giants like Microsoft, Google, and Amazon straddle the space, offering both enterprise-grade services and consumer-facing platforms, while brands in oil & gas, banking, and pharma operate across B2B, B2C, and B2G simultaneously. Meanwhile, aerospace and defence leaders like Lockheed Martin, Airbus Defence, and BAE Systems remain firmly B2G, their brand value driven by long-term contracts, government relations, and geopolitical relevance.

These distinctions reflect the wide variety of B2B brand strategies captured in this year’s Brand Finance B2B 250 2025 ranking, which has been expanded this year from 150 to 250 brands.

Technology and tensions reshape B2B brand value

While B2C brands still account for a slightly larger share of overall enterprise value - 18% compared to B2B’s 13% - the performance of top B2B brands suggests that this gap may understate their true impact. In many cases, strong B2B brands are already priced into the market, or their contribution is undervalued due to lower consumer visibility. Yet the top-ranked enterprise-facing brands are increasingly proving that strong brand equity, whether through trust, reputation, or category leadership, plays a critical role in driving commercial growth.

This year, the total brand value of the top 150 B2B brands has risen by 8% year-on-year, representing a near quarter-trillion-dollar increase. This is a continuation of the pace set in 2024, when the top 100 B2B brands total value rose a quarter-trillion compared to 2023, 10% in just one year.

Artificial intelligence remains at the forefront, with adoption accelerating across B2B sectors as businesses seek greater efficiency, innovation, and cost control. Brands most associated with AI and cloud infrastructure - such as NVIDIA, Microsoft, and Amazon - feature prominently in the 2025 ranking. Microsoft is again the world’s most valuable B2B brand, with its value growing by a third this year to USD292 billion. As such, it is worth more than the next three combined: Amazon, NVIDIA, and State Grid.

These tech B2B brands also benefit from highly regarded leaders. Microsoft, NVIDIA and Google CEOs also rank 1st, 3rd and 5th respectively in Brand Finance's list of top brand guardians. This shows that they operate as positive figureheads for the brand among many non-consumer stakeholder groups.

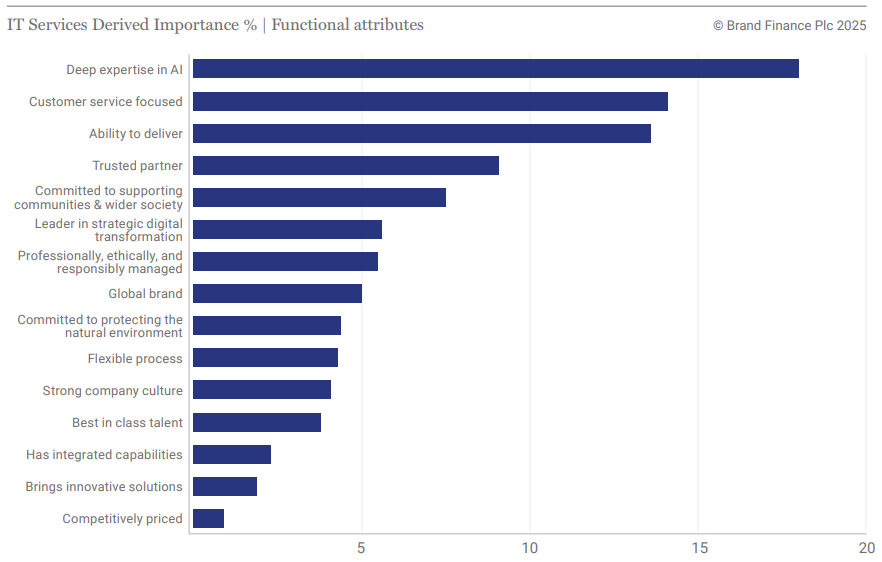

Brand Finance’s 2025 B2B IT Services research confirms that “deep expertise in AI” is now the top driver of brand consideration and preference, surpassing more traditional attributes such as delivery capability. As AI-readiness becomes a key procurement priority, brands demonstrating leadership in this area are seeing stronger brand value growth. The software-as-a-service (SaaS) market shift towards cloud-based enterprise solutions continues, from customer relationship management to HR to project management platforms. The expansion of this year’s ranking reveals the rising presence of digital enterprise brands, such as new entrants QuickBooks (162nd) and Workday (242nd).

Geopolitical tensions are reshaping priorities across many B2B sectors, with national security concerns rising. Global defence spending reached record levels in 2024, driven by growing security threats, the modernisation of defence systems, and increased investment in cybersecurity and artificial intelligence. As a result, aerospace and defence B2B brands are growing more valuable, with several leading players entering or climbing the ranking.

Major defence brands such as Lockheed Martin (86th), Northrop Grumman (152nd), BAE Systems (163rd), and General Dynamics (171st) have benefitted from rising demand and long-term procurement commitments, while established leaders Boeing (48th) and Airbus (53rd) remain among the highest-ranking B2B brands globally.

Global spread reflects economic and sectoral dynamics

The United States continues to dominate the global B2B brand landscape, with the United States’ aggregate B2B brand value of USD1.7 trillion accounting for just over half (52%) of the total brand value of USD3.34 trillion in the ranking, a slight increase from 51% last year. With 111 brands featured in the ranking of 250, the scale, maturity, and international reach of the US business ecosystem are clearly reflected in the value of the country’s brands.

American B2B brands operate across a broad range of models, including purely B2B, mixed business and consumer focus, B2B2C, and B2G, demonstrating versatility in value creation across both private and public sectors.

This dominance is underpinned by the highly interconnected nature of key US industries, particularly in commercial services, technology, and aerospace and defence. Government investment, especially in infrastructure and national security, has further bolstered the position of brands operating in B2G contexts.

Beyond the US, the distribution of B2B brand value becomes more fragmented. Brands of Chinese and European origin each make up 16% of the total brand value, however Europe is represented by 57 brands across a wide range of industries earning revenues globally, whereas China contributes 32 brands which earn 91% of their brand value within China, and 24 have 'China' in their name.

Although fewer in number, Chinese brands tend to be large, state-influenced players like State Grid Corporation of China (B2B Value $84.0bn) operating in strategically important industries such as banking, oil & gas, and heavy industry like Sinopec Group (B2B BV $29.8bn). While domestic scale and policy support remain key strengths, these brands face growing challenges in Western markets due to increased scrutiny around data governance and government affiliations.

Europe also contributes 16% of global B2B brand value, distributed across a broader base of 57 brands. This reflects a more decentralised and sector-specialist landscape, with strength concentrated in automotive (Michelin USD8.8bn, Mercedes-Benz USD6.6bn), industrial manufacturing (Siemens Group USD25.9bn), and pharmaceuticals (Philips USD10.7bn). These brands are rooted in longstanding reputations for quality, engineering excellence, and sustainability leadership, with many having built equity over decades of consistent performance and global presence.

Asia (excluding China) accounts for 11% of total brand value, represented by 34 brands, many of which are diversified conglomerates headquartered in Japan, South Korea, and India. Leading contributors include Mitsuii (USD21.2 billion), Samsung (USD37.3 billion), Tata Group (USD28.1 billion), and SK Group (USD21.5 billion). These firms benefit from long-established reputations, vertically integrated operations, and global reach across sectors such as electronics, construction, and financial services. 18 of the 34 brands from this region are conglomerates.

The Middle East and Canada each contribute 2%, five brands from the Middle East and nine Canadian brands in the top 250. Middle Eastern brands are heavily concentrated in energy and infrastructure (Aramco ranked 8th), while Canadian brands benefit from close trade and regulatory alignment with the US, though this advantage may be tested as protectionist measures and tariff uncertainties continue to evolve. Australia is represented by two brands, a comparatively limited international footprint in B2B sectors.

Leaders by brand value

Microsoft retains its position as the world’s most valuable B2B brand this by a considerable margin. The brand has increased its B2B brand value by a third (+33%) to reach a staggering USD292.5 billion. Microsoft’s position at the top of the B2B ranking reflects its continued strength across cloud, AI, and enterprise productivity.

Azure revenue surged 33% year-on-year, with AI workloads accounting for a significant share of growth. The brand now serves over 60,000 organisations through Azure AI services alone, up 60% year-on-year. Microsoft’s integrated offering, from infrastructure to applications, has cemented its role as a core enabler of digital transformation.

Amazon (B2B brand value USD110.9 billion) reclaims second place this year, recovering its position after slipping to third in 2024. The company’s brand value has seen impressive year-on-year growth, up 60%, driven primarily by performance in its Amazon Web Services (AWS) division. AWS revenue surpassed USD100 billion, as demand for cloud computing and AI services continues to accelerate globally.

NVIDIA (up 98% to USD87.9 billion) claims third position, marking its highest-ever placement following exceptional brand value growth over the past year. It is also the second fastest-growing brand in the ranking, NVIDIA’s rise reflects the company’s central role in powering the global AI and cloud computing ecosystem.

Continued demand from hyperscale cloud providers and expanding applications in automotive, including new partnerships in autonomous vehicle technology, have contributed to the brand’s increased relevance and commercial momentum. The brand’s strong performance underlines the wider surge in value seen across semiconductor and enterprise software brands in 2025.

Leaders by brand strength

China Construction Bank (brand value USD34.8bn) is the strongest B2B brand in the world, with a Brand Strength Index (BSI) score of 93.7 out of 100.

Brand Finance’s research, conducted in China, reveals that the bank enjoys exceptional brand equity across key metrics, achieving perfect scores in both Preference and Recommendation. Its strong performance reflects not only high levels of customer trust but also its scale and central role within China’s financial system.

PayPal (brand value USD18.5bn) sits in second with a BSI score of 93.6 out of 100. As one of the most established names in global digital payments, PayPal benefits from first-mover advantage and wide-ranging familiarity across major international markets. Brand Finance research shows that the brand achieved near-perfect BSI scores - between 98 and 99 - in France, Germany, Italy, the UK, Australia, and the US.

Microsoft is the third strongest B2B brand in the world with a BSI score of 93.2 out of 100.