This article was originally published in the Brand Finance Banking 500 2025 report

Managing Director,

Brand Finance Brazil

Managing Director, Brand Finance South America

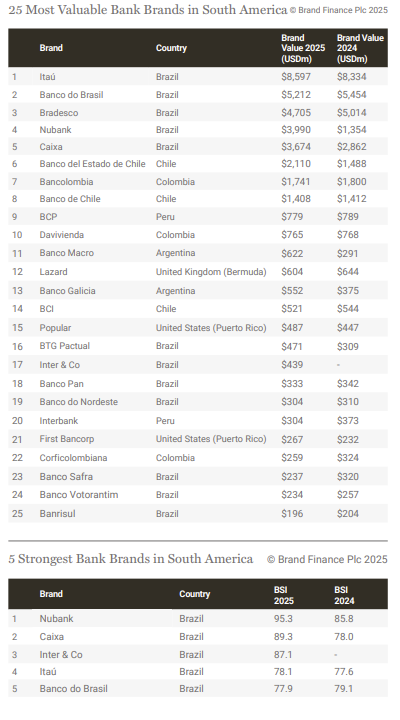

In 2025, six Latin American nations are represented in the Brand Finance Banking 500 ranking.

The region’s national regulatory regimes result in strategic brand positioning with a strong emphasis on digital banking and financial inclusion. Institutions such as Itaú, Nubank and BancoEstado have leveraged innovation to boost their brand values and global competitiveness. Banks with declining brand values, such as Inbursa, Compartamos, BCI, and Corficolombiana, require a renewed focus on modernisation and customer experience to regain momentum.

BRAZIL

Brazil’s banking sector dominates the region, with 13 banks featured in the ranking, a testament to the country’s well-established financial infrastructure, rigorous regulatory standards and pronounced commitment to digital transformation.

Itaú (brand value up 3% to USD8.6 billion) leads the pack with a Brand Strength Index (BSI) of 78.1 and an AA+ rating. Despite the slight drop in the "appeal" driver, the brand's other touchpoints continued to grow, keeping its BSI growing, according to the Brand Finance survey. As Brazil’s largest bank by total assets, Itaú’s strength lies in its ability to blend traditional banking operations with state-of-the-art digital services. Its diverse portfolio, which includes investment banking and wealth management, underpins robust market positioning and international appeal. Memorable advertising campaigns accelerate the growth of brand strength. The “Made of the Future” campaign, which featured Jorge Ben Jor, Madonna and Ronaldo Fenômeno, positively impacted the brand’s awareness drivers and positive associations.

Banco do Brasil (brand value down 4% to USD5.2 billion) has a similarly high BSI of 77.9, also rated AA+. Brand Finance research found that Banco do Brasil has achieved extremely high ratings for familiarity and assurance, leading to its products obtaining substantial price premiums based on its brand strength. Its status as a partially government-controlled entity confers stability. It enables a broad branch network, while its diversified services—including agricultural financing—enhance its competitive edge in domestic and international markets. Bradesco (brand value down 6% to USD4.7 billion) has a BSI of 72.8 and an AA rating. Despite experiencing some recent declines,

Bradesco’s legacy and entrenched customer base maintain its reputation as a cornerstone of Brazilian banking. Its diversified operations in insurance and investments further fortify its position. In addition, the Bradesco brand has grown in several segments, including insurance and social actions, such as the Bradesco Foundation and its social responsibility actions, which increase its positive brand perception.

In the digital space, Nubank (brand value tripling to USD4 billion) has achieved a remarkably high BSI of 95.3 and an AAA+ rating, an example of how a technology-first brand can disrupt a traditional market. Nubank has the highest score in familiarity, reaching 10 out of 10. According to the Global Brand Equity Monitor, the global market research by Brand Finance shows that the improvement in brand strength performance is growing. Its rapid customer acquisition, mobile banking experience and use of artificial intelligence have expanded Nubank’s domestic influence and cemented its role as a leader in digital finance.

Caixa (brand value up 28% to USD3.7 billion) has played a key role in public policy, particularly in social benefits and housing finance, differentiating it from its peers. The Caixa brand develops these activities through social programs and grants paid to vulnerable citizens by the federal government and incentives for real estate financing for families in low- or middle-income conditions.

While the top five banks dominate, Brazil’s smaller institutions also tell an essential story about the diversity of the market. BTG Pactual (brand value up 52% to USD471 million) is a leading investment bank that emphasises wealth management and trading. Inter & Co (brand value USD439 million) benefits from its rapid growth as a digital bank offering a full suite of services. Its customer-centric model is particularly notable given its relatively small market capitalisation compared to the traditional giants.

CHILE

Banco del Estado de Chile “Banco Estado” (brand value up 42% to USD2.1 billion) stands out in Chile, climbing 23 positions to 135th and an AA rating. As a state-owned institution, the brand has the dual advantage of supporting public policy while driving financial inclusion. Banco de Chile has implemented various marketing initiatives, including the ‘Let's Reconnect with Chile’ campaign and developing the ‘Routes for Chile’ virtual showcase. Banco de Chile (brand value stable at USD1.4 billion) maintains a strong market presence. It remains a corporate banking and financial services leader with an AA rating. The bank’s ongoing investments in digital transformation and sustainable banking practices are central to its strategy for long-term growth.

BCI (brand value down 4% to USD521 million) has an A- brand strength rating. Despite recent setbacks, BCI’s investment in digital solutions and products tailored to small and medium enterprises positions it favourably for future recovery and growth.

COLOMBIA

Bancolombia remains Colombia's most valuable banking brand, now positioned at 153rd with a brand value of USD1.74 billion and an AA rating. Although it has dropped eight positions, its commitment to digital banking and regional expansion is evident and may position them for improved brand value as the bank underscores the importance of leveraging technology to improve customer engagement and operational efficiency.

Davivienda, positioned at rank 249 with a brand value of USD765 million and an AA rating, has seen a modest 10-position decline. Despite the slight drop, its ongoing investments in digital transformation and customer experience innovation keep it competitive. Davivienda’s strategic focus on retail banking has allowed it to build a strong, customer-focused brand that is well-adapted to evolving market needs, instilling confidence in its future growth.

Corficolombiana experienced the most significant decline in Colombia, falling 52 positions to rank 442. With a brand value of USD259 million and an A- rating, the bank now faces steeper challenges in maintaining its competitive edge. While still important, its role in corporate banking and investment services suggests that a more aggressive digital strategy may be necessary to regain lost ground in a rapidly changing financial landscape.

PERU

BCP (brand value down 1% to USD779 million) continues to focus on digital transformation while maintaining an extensive branch network. Its commitment to increasing accessibility to financial services is evident in its strategy to bridge traditional banking with modern digital offerings. BCP’s advertising uses irony and has drawn criticism, but so far, it seems to be a net positive for the bank’s brand performance. Interbank (brand value down 19% to USD304 million) suffered a more notable decline.

Interbank’s emphasis on innovation, particularly its customer-centric approach and investment in digital banking, has allowed it to remain competitive despite its lower brand value. The bank’s focus on technological advancements is a reminder that modernisation, even in the face of temporary setbacks, is key to long-term success in an increasingly digital market. An October 2024 cyberattack froze the bank’s operations and possible exposed data to hackers, resulting in decreased trust in embedded technologies and negatively impacted the value of the Interbrank brand. Reputational crises are inherently a risk for digital banks that may face operational instability or system intrusions.

ARGENTINA

The Argentinian economy has faced very high levels of inflation and long-term economic instability. Recently, an economic model proposed by President Javier Milei to dollarise activities has driven inflation to almost 300% in 2024 when measured in Argentinian Pesos. However, this has been closely connected to significant improvement in the value of Argentinian banking brands when measured in US Dollars.

Banco Macro (brand value more than doubling to USD622 million) has recorded a striking improvement, leaping 133 positions in this year’s ranking to become the world's 277th most valuable banking brand. Its focus on business banking, especially in the agricultural sector, has enabled Banco Macro to capitalise on opportunities in a challenging market. The bank’s strategic investments in technology and customer service have been instrumental in its resurgence, reinforcing its domestic and regional competitive position. In a landscape where fintechs increasingly shape the financial ecosystem, Banco Macro stands out as a strong and versatile option for large corporations, SMEs, and entrepreneurs.

Banco Galicia (brand value up 47% to USD552 million) has similarly grown while demonstrating its commitment to sustainability by achieving carbon neutrality in 2024.

On the commercial front, investments in digital banking and adopting a customer-centric approach has helped Banco Galicia navigate economic uncertainties while maintaining a strong retail presence. Its ability to adapt to rapid technological change has been key to its improved ranking and overall market performance.