Whether and how to transition a brand should be determined by a simple guiding principle - what creates the most business value? This seems obvious, but more often than not the reasons for when, and why, to rebrand is derailed or mired in politics.

Transitioning a brand is an expensive and labour intensive endeavour. A good deal of due diligence is required to maximise the business value that can be generated.

In this piece, we are jumping right into how to deploy a brand transition strategy. If you would like more information on the context for a brand transition, please see my earlier piece - Brand Transition: When and Why Should I Rebrand?

Deploying a Brand Transition Strategy

This will be determined by limiting costs and pushing them as far in the future as possible, and maximising earnings as soon as possible. In order to model these fundamental elements of business performance the broad steps to be followed are:

- Understanding the brand and business’ drivers of value

- Clarifying objectives, scenarios and initial hypotheses

- Planning post-switch actions

1. Understanding the Brand and Business's Drivers of Value

In order to identify the business impact and return on investment of any brand decisions, it is important to establish the drivers of value in the business.

Understanding these drivers and using this understanding to build a flexible business valuation model that can be adjusted for different scenarios is the first step for analysing value potential.

They might be related to pricing for example. Utilities providers find that their return is extremely closely linked to the margin they are able to collect on fuel and electricity sales. Any impact from a change in brand on the price it can charge could shave large amounts off its profitability. If pricing is not reduced in order to maintain margins customers could be lost, again reducing overall profit.

They may also be related to customer acquisition. Uber is a company in a high growth market and its value is dependent on its ability to grow its customer base in the anticipation that a large market share will generate profit in the long run.

They may be related to customer retention. Banks derive their value from their ability to generate lower borrowing costs through current and savings accounts from their customers and their ability to cross-sell other products. Since it is a low growth but high competition sector in most developed countries, maintaining that customer base is key.

Or they may be something else: a wholesale energy supplier will be more interested in regulatory agencies allowing it access to wholesale markets; a professional services firm may be more interested in recruitment, and another company may find supplier costs a more important driver of value.

2. Clarifying Objectives, Scenarios and Initial Hypothesis

As we have already established, there are many benefits expected from transitioning from one brand to another. As a reminder, some of the key ideas are:

- That the brand is expected to be more efficient in translating marketing money to preference

- It is more effective in creating a market for new product launches

- It is intended to reduce the overall group cost of marketing

Modelling relies on testing the impact of these objectives. Each effect requires different types of research and different elements in a valuation model. Since analysing unnecessary elements can be costly, confusing and pointless, clarifying what these are is essential at the outset.

Similarly, when analysing a brand switch it is usually not as simple as reviewing the impact of one business model against a totally different business model as the journey from one to the other is as important as the end state itself. This journey might include: the time taken to prime the market for the switch; whether a period of endorsement is necessary; the design of the new or endorsed logo; and the level of marketing investment support.

Initial analysis of brand strength, media channel effectiveness, available spend in the media market and available resources in the business is needed to identify a small number of potential options to choose from.

Once these options are established, creating initial hypotheses on the effects of scenarios can help to set up modelling and corroborate findings. For example, if you know that communicating with customers usually leads to higher churn regardless of content or that competitors have

been known to use negative adverts, it may be necessary to review those effects when modeling potential impacts. Alternatively, if you are aware that 15% of a previously transitioned brand’s customers churned on the switch then significantly different results for the analysed scenarios would be a reason to revisit assumptions.

Once these analyses and hypotheses have been used to create a hierarchy of options – with an identified sensitivity of results – a decision can be made on the best approach.

3. Planning Post-Switch Actions

The previous step enables the different brand options to be evaluated under ceteris paribus (steady-state) conditions. However, once a particular option is chosen it is necessary to identify the most effective approach for transitioning the brand’s touchpoints, whether there are any efficiencies to be made in investment in marketing, and the method for tracking performance during any interim period and the preconditions for full transition.

There are usually many items where the brand is seen that need to be updated, like merchandise and office supplies, websites and other IT infrastructure, outdoor signage, logistics vehicles, events, and packaging to name a few. Rebranding all at the same time can create a ‘big bang’ that improves the impact of the rebrand.

However, it can be hugely and unnecessarily costly and, since switching too quickly can have an impact on quality, it does not always deliver the positive impact predicted. Therefore, some touchpoints that are less often seen or are less impactful can be left and replaced at the end of their replacement cycles while others should be changed immediately. Identifying the cost and impact of transitioning each touchpoint is therefore necessary at this stage.

It may also be possible to use available media more effectively to increase the impact of any change. A customer newsletter that can reach 20% of the market or a sponsorship property that can reach 15% can build huge amounts of awareness and preference with almost no investment since only the brand’s application needs to change. Interesting PR or new advertising creative as well can improve the impact of media and their effects for the same or limited extra spend and can and should be tested.

All of these activities – which may include organisational change too – will have expected impacts, modelled through a model based on market research and financial information. However, these models are based on expectation which identifies the most likely outcome, not the exact outcome. Therefore, it is important to track performance over time and make changes to activities to ensure timelines and targets are met. The type of tracking depends on long term objectives but at its simplest, understanding familiarity and preference for the new brand versus the old is a simple way to keep track since this enables the content and quantum of any media investment to update as the market’s customers progress down the marketing funnel.

What To Do With Your Old Brand

If the brand is very or even moderately strong, many people will remember and think positively of it for a very long time. Despite this, businesses decide to discontinue using the brand entirely surprisingly often. This can have an impact on reported financial performance – which I will not cover here – and also on the real commercial performance of the business.

The ability of brands to maintain their strength for a considerable amount of time is best illustrated through examples from one of the most pre-eminent books on branding, Managing Brand Equity by David A. Aaker (1991, Free Press):

Datsun: Despite introducing the Nissan brand in Japan after WW2, the Datsun brand was used when the company entered the U.S car market in 1961 but twenty years later, between 1982 and 1984, global strategy dictated that the brand change from Datsun to Nissan in the U.S.

At the start of this period, there was virtually no awareness of the Nissan name, the rebranding was carried out gradually but, still, approximately US$240 million was estimated to have been spent on the “The Name is Nissan” advertising campaign, and total advertising costs were estimated to be in excess of $500 million.

Despite this, the recognition and esteem of Datsun in 1988 was essentially the same as that of Nissan despite the virtual absence of the Datsun name from the market for five years and all the money and effort that had been placed behind the Nissan name.

Black & Decker acquired General Electric’s (GE) small appliance business in 1985, changing the name almost immediately. A US$100 million advertising campaign increased awareness of Black & Decker as a maker of small kitchen appliances from 15% to 57% during the first 18 months. However, the GE name proved persistent. Three years after the change the GE brand was preferred over four times more often than that of Black & Decker.

These examples may show to some people an ineffective or pointless brand transition but my purpose in showing them here is not to pass judgment. Rather, it is to highlight the fact that brands retain their value for a long time after removal. Although immediate recall awareness may fall quickly, it can be reignited through advertising long into the future and underlying perceptions can make them far more effective than using a totally new brand.

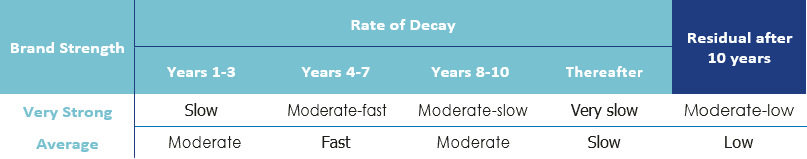

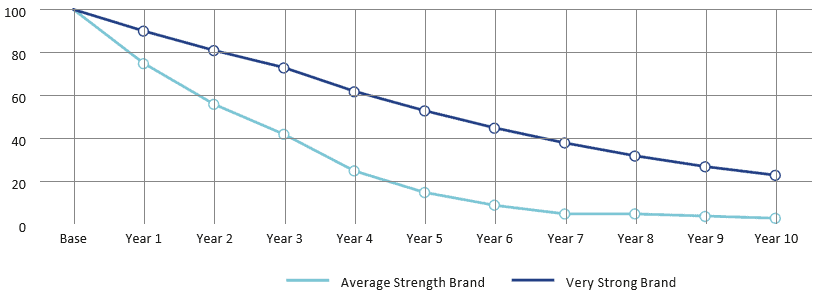

Although decay rates in brand perception are different between sectors, markets, and brands, a high-level summary of what is generally seen is shown below:

This presents an opportunity to generate huge amounts of money, usually left on the table by companies after a rebrand. Many businesses simply store their brands in their trademark schedules waiting while they wither and die, surprising since there are many opportunities to use them: sell them through the burgeoning industry of trademark exchanges – like LIPEX; continue to manage their use in adjacent categories; or licence them to third parties.

Provided that the use is governed by strict, audited non-competitive rules and the proposition is strong many brands can find new life in other ways. One need only look to Dunhill to see how a brand scaled back in one category can be hugely successful in another, in Dunhill’s case Tobacco to Luxury Apparel.

Even if it is eventually decided the risk of ruining the success of the rebrand is too high, a new use for the old brand should always be a consideration during planning since the potential money involved may influence the initial decision.

What next?

Decisions to transition a brand can be complicated, political and expensive. Creating robust, monetary assessments of the potential approaches – or indeed whether a brand should be transitioned at all – can make group decisions easier as well as improve overall outcomes.

In order to have this quality of analysis, the steps to follow are:

- Internal Review: Create a cross-organisational understanding of the purpose for any brand change through workshops, seminars or questionnaires.

- External Review: Develop an understanding of trends among similar brands and the success of those cases.

- High-level Valuation Analysis: Create high-level brand valuation models to identify to what extent a change is likely to drive value by simply altering brand strength – to create a burning platform for change.

- Consider the Detailed Financial Arguments: Develop an understanding of the potential impact on value through direct effects on acquisition and churn.

- Create Structured Scenario Analyses: Compare the effects of time, design, investment and other factors to restrict your options to a very short shortlist of potential options to choose.

- Plan and Track the Execution: Create a plan to deliver the highest impact for the best quality and lowest cost through changes to brand touchpoints, plan media investment and set up a tracking system.

- Use or Lose Your Old Brand: Decide whether it is appropriate to sell, use or licence your old brand.

Increasingly, many of the best brands are considering and testing all brand-based decisions against the prism of shareholder value and return on investment. This is good news and the techniques used can be simple as long as the assumptions are clear and the financial arguments intelligible.

Elevating the discussion above cost to an understanding of how changes impact customers and demand then weighing everything up to understand overall shareholder value can be done by all brands. It should. Bringing brands and marketing to the boardroom is good news for everyone.