There are quite a few lessons buried in crises throughout history we should be aware of to avoid repeating the same mistakes that brands made in the past.

Winston Churchill once said, “the farther back you can look, the farther forward you are likely to see.” There are quite a few lessons buried in multiple crises throughout the history we should be aware of to avoid repeating the same mistakes that brands made in the past.

Brand Investment And Brand Strength In Times of Crises

During times of crisis, many companies resort to systematic marketing spend cuts, without considering long-term consequences of this action.

Current pandemic is no exception. According to a recent IAB survey1, “nearly a quarter (24%) of respondents have paused all advertising spend for the rest of Q1 & Q2.”

However, what we are really interested in exploring is why companies systematically cut their investment in communications in times of crisis. There may be a few theories, but I think there are five key reasons that stand out:

- Because it´s easier to cut marketing budgets than firing people, for example

- Because brands are not considered as long-term assets that require continuous investment to protect their value

- Because it is wrongly believed that, after “going dark”, marketing investment can be increased again without any long-term harm. In reality, the problem is that the long-term effect that these cuts can have is not understood

- Because, generally, the key communication performance metrics (if any used at all) are not linked to value creation. If the metrics of the marketing measurement system do not explain investment profitability, it is very difficult to justify why it should be maintained in times of crisis at all.

Academic and empirical evidence shows that crises represent ideal time to take advantage of opportunities in a market in which most competitors are cutting back.

Peter Field (2008)2 analyzed 880 companies from the IPA database and showed that brands that increase their Share Of Voice (during recessions and boom periods) are more likely to increase their market share. The short-term benefits of reducing budgets in a recession were offset by the drop in long-term profitability (which was most acute after a third year of reduction).

But while some companies cut down on their marketing spend, others have historically gone in for the kill and took the opportunity to “steal market share” during financial crises. A.G. Lafley, the ex CEO of Procter & Gamble, used to say that at P&G they had "a philosophy and a strategy: when times are tough, we build market share."

The Drum has recently reported that P&G has committed to continue investing in communications to retain the “mental availability” of its brands 3. Increased media consumption creates an opportunity to “double down” on brand visibility.

So, the first lesson learned from past crises: maintaining or increasing advertising investment during a recession, increases market share during the recession and the profitability in the long run.

Brand Strength and Business Performance

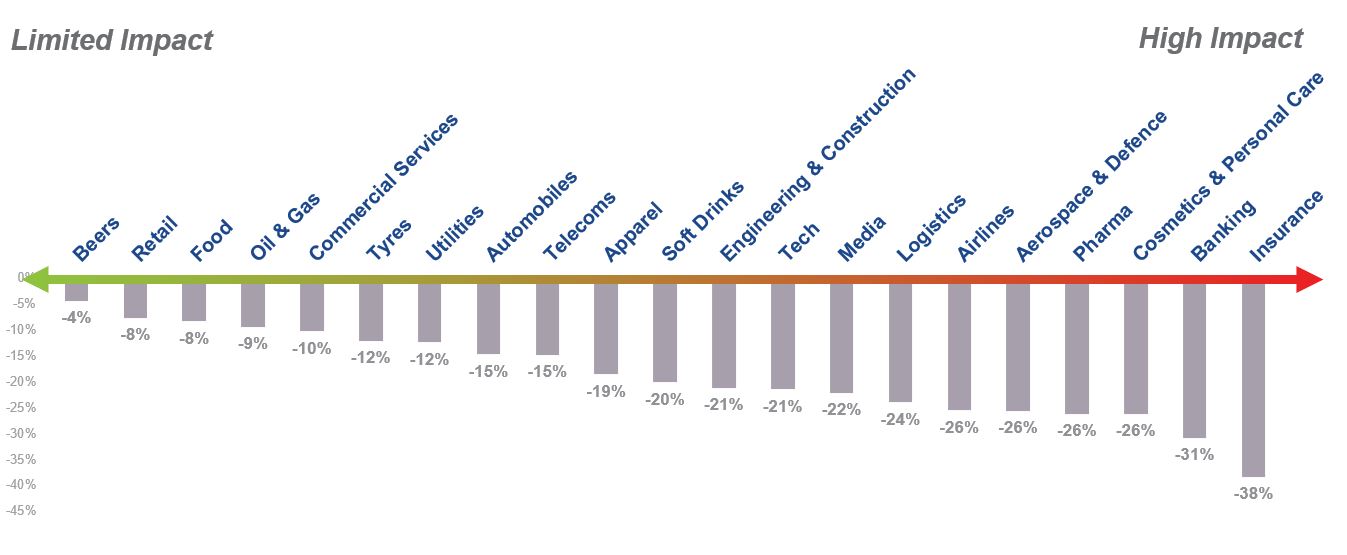

We conducted an analysis of the brands that had been most affected during the 2008 crisis in terms of negative impact and brand value (see Figure 1).

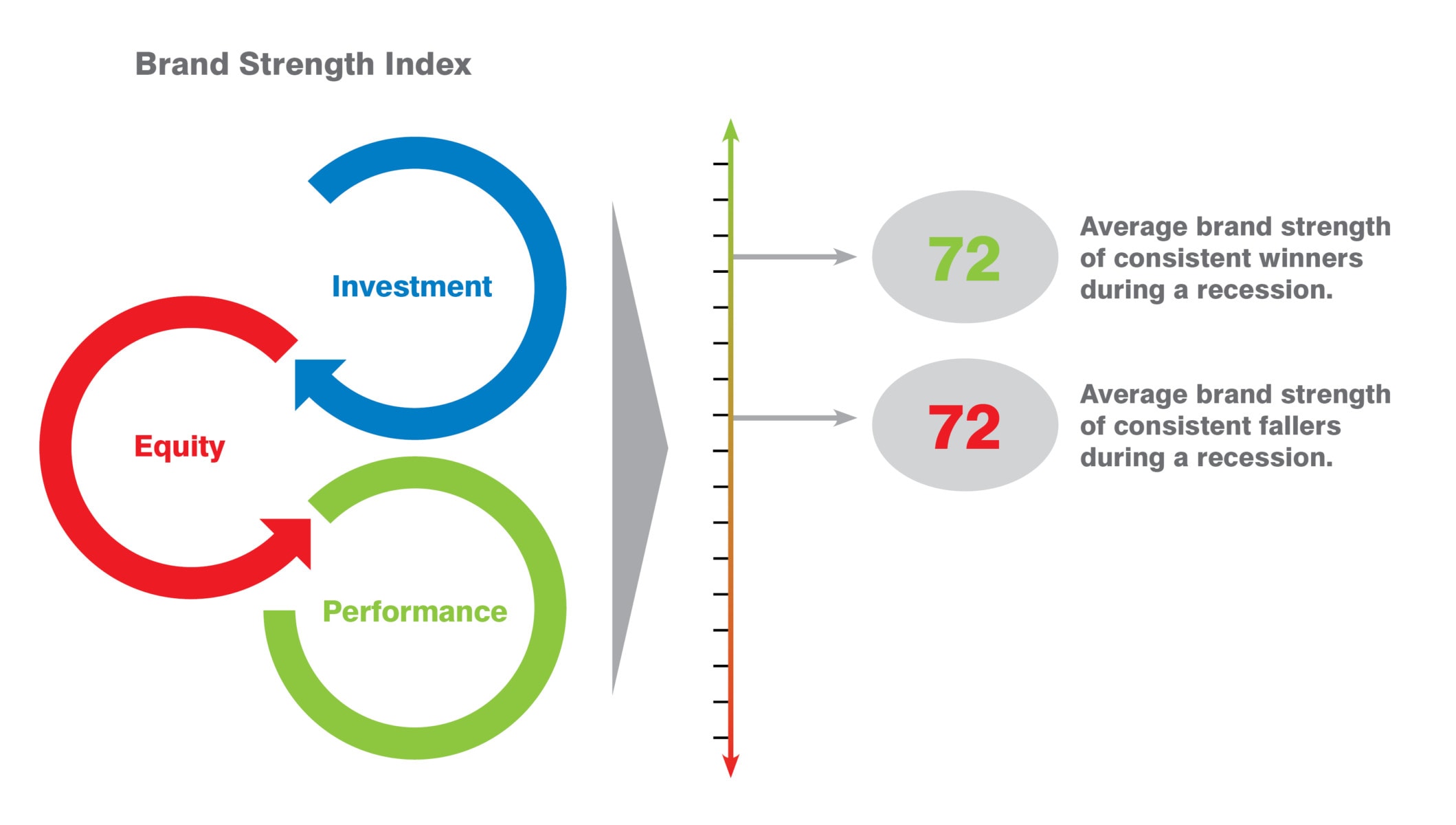

Within these sectors, not all brands performed equally. Our analysis reveals that during past crises, stronger brands are consistent winners during a recession (see Figure 2).

In addition to measuring overall brand value and understanding brand resilience through crises, we also evaluated the relative strength of brands, based on factors such as marketing investment, familiarity, loyalty, staff satisfaction, and corporate reputation. Alongside revenue forecasts, brand strength is a crucial driver of brand value. We monitored brand value fluctuations during the three major economic downturns experienced in 2009, 2012, and 2016.

The key takeaway of this long-term analysis is that strong brands perform better during crises, across all sectors.

Conclusion

In short, investing in communication (understood in a broad sense, not only as an advertising investment) is profitable. Although it may negatively impact profitability in the short term, it increases brand strength, which will bring more profits in the long run.

As The Economist recommended back in the 2008 crisis, "it is time to go in for the kill."

Managing Your Brand in a Crisis 101

How Has COVID-19 Impacted Brand Value and What Can You Do About It?

5 Ways to Manage Your Brand In Times Of Crisis

Managing Your Brand in Times of Crisis: Lessons From the Past

How Brands Can Overcome Unprecedented Crises

- IAB (2020), “Coronavirus Ad Spend Impact: Buy-side”. Survey

conducted by IAB and published on March, 27. https://www.iab.com/insights/coronavirus-ad-spendimpact-buy-side/[↩] - Field, P. (2008), “Marketing in a downturn: lessons from the past,”

Market Leader, Autumn 2008. http://lit.bestmarketing.com/files/menu//2009012301085656.pdf[↩] - Deighton, K. (2020), “P&G ramps up marketing amid coronavirus demand: This is not a time to go off-air,” The Drum[↩]