Brand licensing analysis helps brand owners to notice areas of improvement, guide investment and maximise value growth.

Intangible assets work together to multiply business value by increasing revenue, finding cost efficiencies and reducing risk, and mapping those interactions helps to maximise these effects.Setting up a central BrandCo is the best way to measure, manage and invest in brands and most of the best companies in the world - take it from Apple to PepsiCo to Shell.

The process of identifying intellectual property, understanding it's value and contribution to the business and pricing it according to performance helps business directors to notice areas of improvement, guides investment, and maximise value growth. Brand Licensing necessitates the formal auditing of brand (and IP) ownership and uses its valuation and pricing. It also helps to put brands and licensing at the heart of decision-making.

In order to get it right from the offset, this article is intended to show how to understand the way in which brands and intellectual property create value, as well to illustrate the characteristics of successful businesses.

Make licensing decisions using hard data. See our consulting services for more detail, or contact us directly. We love to talk.

Economics of Intangible Assets

To understand the appropriate way to manage, invest in and exploit the value of brands and other intellectual property, it is useful first to grasp the way brands are build and how they build value in businesses.

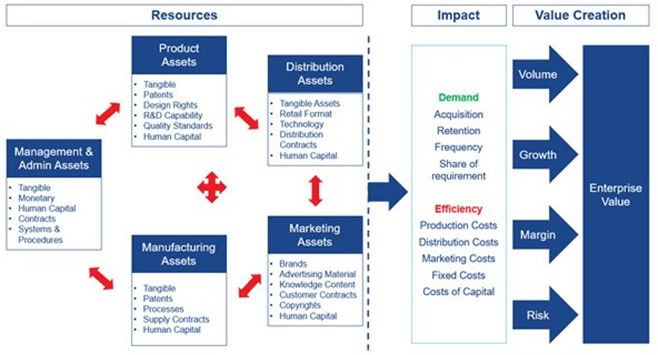

It is a well-established fact that the value of businesses is determined by the free cash flows they are able to generate for holders of their shares and debt. In order to be valuable, technology, trademarks and other intellectual property have to work together in order to generate cash flows – typically by creating cost efficiency, increasing demand/price or reducing risk.

First, however, it is important to understand how the economic characteristics of IP are different from tangible assets. For example:

- The value of IP is generally not reduced through use and can be used simultaneously by multiple parties

- The cost of building IP is usually not closely related to the resultant value. There is a high risk of wasted investment (particularly when the concept is untested) but there is high upside potential if the property is successfully commercialised.

- IP derives its value by being used with other assets (tangible and intangible).

- IP is commonly licensed on its own but generally sold as part of a business, so royalty payments are often available but individual Values are not.

- An individual “asset” is usually a collection of individual rights that derive value as a result of being licensable together as one (e.g. a domain, trademark, slogan, logo etc. make up a “brand”).

Knowledge of the value contribution of these assets – the building blocks of enterprise value - and the linkages between them is essential for appropriate management and investment, which inevitably leads to competitive advantage and further opportunities to build value. The interplay between different assets depends upon: the quality of the IP and its management; the industry; the country; and the stage of life of the business among other factors.

An illustration of how IP interacts in stages of the life of a business can be seen below. Innovation is important to start with, but this drives reputation, which adds value and can sustain a company through periods of lower innovation. Knowledge of these interactions helps to understand what rates should be charged but also how to focus investment.

Brands work with other intangibles to build value and growth...

It is important to conduct due diligence on what intangible assets you have, what they do, and how they interplay with other assets, risks and activities in your business or prospective business model.

Understanding the way your assets link together to drive demand and efficiency – and therefore the value of your business – should be a top priority. Value maps can be used to identify these links with other resources and the relative importance of each asset within a business.

It is important to note that these value maps are most relevant when brought down further to the different asset classes. Brands, in particular, have a mixture of mutual value-generating assets and related activities often owned and managed in many different parts of a business.

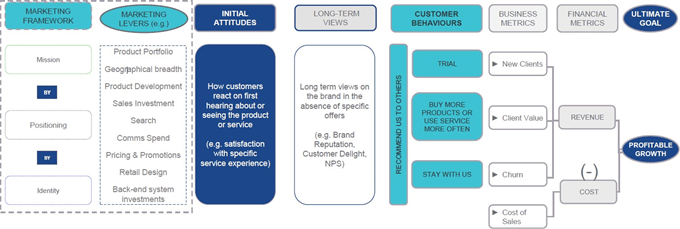

Understanding the feedback loop of positioning, through to and back from marketing levers, attitudes, and behaviours can help to identify what needs to be tweaked to improve demand and hence profitability. It can also help to identify poor performance internally, or within a market, at the earliest opportunity. An overview of this value map for brands and marketing can be seen below.

Changes in marketing frameworks and levers impact on how customers interact with and feel about the business and its brands. This changes their likelihood to purchase, churn or buy more services. Having a view on these connections can highlight what needs to be improved to capture more value from the brand – whether licensed or not.

The direction and extent of the inter-resource and activity resource relationships, as well as their relative importance as value drivers, can be estimated using a combination of: market research, statistical analysis of historical data, and Delphi techniques. When determining the value of brands and other intangible assets to a new business, you assess their value by reviewing the incremental uplift in value from use. When determining their value on an existing business, you need to disaggregate their value from the total enterprise value – for example, what would happen if you were to lose the brand?

How do you ensure your internal or external brand licensing ecosystem maximises the benefits and minimises the risk?

Many companies have used structured internal or external brand licensing programmes to build incredible businesses. These companies tend to exhibit similar traits:

A Dedicated Division or a BrandCo:

Dedicated brand management divisions or ‘BrandCos’ (internal, group companies specifically created to own and manage brands) are more or less essential for coherent, international management of a brand portfolio – whether the brands are being externally licensed or not.

This usually involves having dedicated teams to provide overall strategy, support licensee relationships, ensure trademark filing compliance and the adequacy of the breadth of your trademarks, brand management like provision of guidelines or communications content, performance evaluation and many other closely related functions that need to be considered in tandem.

This function then extracts part of the value exploited by the companies operating the brand to recompense itself for the value it creates and shares through its services and assets. This is usually in the format of a royalty rate but in some cases is a simple cost-sharing arrangement.

This provides a number of important benefits:

Better brand and IP management. Brand strategy is centrally organised and managed. All parties using and providing the assets are contractually bound to use them in pre-sanctioned ways. This generally leads to the separation of broad, strategic investment decisions from short- term tactical activities which helps to build brands and IPs as strategic assets rather than solely as tactical resources. The specialisation and centralisation of roles also usually leads to cost synergies.

Tighter governance and control. It is easier to create a consistent, international approach to ensuring trademarks/patents are registered and renewed and that all necessary actions for protection are pursued with appropriate vigour. This is particularly important given that the legal action is often cross-border. Internal and external licences with the single entity clarifies the rights and responsibilities and then a central team is tasked with ensuring compliance in a fair and consistent way across all users.

More efficient resource allocation. Brands can demonstrate their financial contribution to the business through a separate income statement, better justifying marketing investments and demonstrating ROI. The creation of royalty revenue also creates a cash balance that can be used to reinvest in the building of the brand.

It also avoids internal companies or divisions from taking valuable intellectual property for granted and damaging them through misuse and builds a focus in functions like finance and legal about the benefits and value of strong intellectual property.

Higher earnings from external licences and clarity on internal prices. A BrandCo operates as a profit centre, enabling incentive structures for management to maximise third party brand licensing revenues. Also, from BrandCos, brands can be more efficiently licensed into non-core areas of business, creating new revenue streams.

Finally, external licenses can help prove the appropriate price for internal license rates to tax authorities – often difficult to do with only third-party comparisons.

Strong Oversight and Planning:

The brand and brand experience are closely controlled in order to maintain the highest operational standards and experience. This begins with the careful market selection and franchisee selection. However, it also involves a clear mapping of how value is being created by brand and IP and regular quality audits of all areas of the brand and business to ensure seamless quality. This also obviously means that licensors need to be prepared to cancel licenses for under-performance or non-compliance.

Where this goes well you shouldn’t notice it, however, where it doesn’t you do. The Easy business (of EasyJet fame), for example, attempted to license its brand in the 2000s but was forced to scale back its expansion as a result of difficulties maintaining quality and consistency of service across all platforms – which led to deteriorating perceptions of quality in its core businesses.

Similarly, the Pierre Cardin brand has even created its own verb in the vocabulary of licensing – the “Cardinisation” of brands refers to those that are so widely licensed with so little regard for the quality of offering that the brand’s reputation in all categories decreases. This, of course, in turn leads to lower demand and price premium and the resultant loss in ability to extract royalties.

Integrated and Diverse Processes & Systems:

They have impressive control processes and management systems for all aspects of managing the franchise. These include a clear and compelling customer experience, a consistent brand identity, communications and messaging (with minimal necessary local tailoring), training, and procurement systems to name a few of the more important.

One thing that should be kept in mind is that this system of support does not necessarily need to be directed from the centre. Sharing marketing and development costs and some returns can help to build stakes in the overall business – leading to innovations and support which benefits all licensees.

Case Study: Ritz-Carlton

Ritz-Carlton is recognised as delivering one of the highest levels of customer service and satisfaction – across all of its 87 hotels and in 29 countries. It has developed what is now considered a legendary training programme, which involves the following:

- All employees must attend ‘Gold Standards’ customer service training programme (employees also carry a wallet- sized training card at all times).

- Ongoing training of 100 hours per employee and test to certify “loyal service” after one year.

- Leadership training about any changes to the brand and Brand Standards.

- Periodic ‘refresher’ courses, with ‘Brand immersion’ sessions provided every 2 years.

- Annual Managers Conference for all Franchisees.

Under the Ritz-Carlton Learning Institute and Ritz-Carlton Leadership Center, the hotel now also operates major service training operations where executives from other major brands worldwide and across many disciplines come to learn The Ritz-Carlton principles of service.

Case Study: McDonald’s

McDonald’s has one of the most synergistic working relationships with its franchisees across the entire franchise industry. With over 35,000 restaurants across the globe (80% of which are franchises), it is fundamental that McDonald’s stays in touch with changing consumer tastes. Especially in the restaurant/food sector, these evolving tastes are extremely diverse and may change rapidly depending on the region, religion and time of year.

To achieve this, the business seeks to achieve greater depth and breadth of consumer insights to inform and inspire its decision- making by employing tools such as:

- Co-creation weekends, spent with groups of consumers, employees and franchisees to help unlock insights into how to build a better business.

- Ethnographic research complemented by a 4,000-sample usage and attitude study.

- Continued use of the brand’s established quantitative tracking tools

- The Breakfast Menu, the Fish Sandwich and most of the successful menu items have all come from franchise owner’s suggestions.

Attention to Detail on Licence Pricing and Royalty Rates:

Many businesses determine royalties based on historic royalty agreements or profitability in similar sectors. However, many of the best and most successful licensors identify the appropriate charge for a brand and other IP on the basis of first principles analysis of the value that they generate to a subject business.

To do this, the performance of the brand should be measured and monitored not only in terms of traditional core brand metrics but in financial, bottom-line value-based terms – what is the incremental ‘brand contribution’ to brand value and to business value from brand activities:

- For the licensee business?

- For the brand owner?

‘Baseline’ brand and business valuation models built, for each licensee market and for the brand owner.

Target KPIs set to promote the desired management behaviour so brand marketing activities contribute to value creation.

Brand Health Tracking and Customer Satisfaction tracker data used to populate market-specific Brand Scorecards and to update the valuation models at regular intervals.

Periodic Review meetings with licensees to check progress against targets, modify strategy and activities as appropriate and share learnings.

Case Study: Multinational Telco Operator

In collaboration with Brand Finance, a multinational telco based across MENAA used brand contribution ‘uplift’ to establish the value created from the adoption of a new brand.

- The uplift in brand and business value, with calculations for economies of scale and central brand group savings in marketing, was used for each market as a basis for apportioning value gained and calculating an appropriate payment fee back to the brand owner. The value-based approach allowed credible business cases to be constructed to justify charges to in-market shareholders.

- Ongoing, market KPIs include both traditional brand metrics and financial value-based metrics.

- Targets by market positioned as a mechanism to help align suitable resources and management behaviours behind a shared goal, rather than an overt ‘means to control’.

- For the brand owner, this should maximise collective performance to achieve a Group ‘brand ambition’.

- 6 monthly reviews planned for all markets.

- The process captures learnings from around the system which can be shared across the Group and discussed in management forums.

Conclusion

Creating a system of central ownership and management for the purposes of managing and licensing brands and IP either internally or externally usually involves forethought and intelligent structuring of the model. The general steps for ensuring that this is done right are as follows:

- Establish the role for brand licensing: Audit and value map all available intellectual property; create and update materials to justify the value of the brand and IP to all users; create a separate business division for brand and IP ownership and licensing; ensure there is enough management time and money to support the team and any changes.

- Develop the strategy for brand licensing growth: Consider expansion options for core and non-core segments separately; determine the pace and direction of growth; conduct a risk assessment to ensure the IP is not damaged unnecessarily.

- Build out the model for investment and governance: Create an integrated brand licensing proposition including but not necessarily limited to brand and core intellectual property; create contractual obligations to be supported by incentives and guidance; create clear guidelines and success criteria to support and judge licensees.

- Determine the structure for brand licensing payments and royalty fees: Continuously identify appropriate royalties using first principles analysis of valuation methods supported by other analyses; keep the fee structure simple; be confident but not exploitative with the fee you plan to charge.

Business structures that involve a form of brand licensing help to put brands and IP in a firm and important position in a business – linking them directly to returns creates an incentive to maximise their benefit. However, to do so, requires some forethought and – in many cases – a clear-up of existing structures. The cases of Apple, Amazon, PWC, Orange, Shell, Coca-Cola and the Ritz among the long list of enacting this type of model shows that bringing brands and IP to the centre of your business brings strong dividends.

If you want to ensure the continued success of your brands and other IP – make sure it is properly accounted for, managed and invested in.