This article was first published in the Brand Finance Global Rebrand and Architecture Tracker (GReAT™) 2020 report.

The Context for Brand Transition

In June 2018, the multinational Enel reached a 93.3% stake in the Brazilian energy distributor company AES Eletropaulo for a total consideration of €1,570 million. At the time, Enel stated that its strategic goals were to:

- Consolidate Enel Americas’ presence in Brazil, becoming a leading integrated player in that country.

- Increase the customer base, with an additional ~7 million premium customers.

- Boost Enel Americas' growth in free market and in the new digital energy services for customers.

- Act on the potential for volume growth with economic recovery.

This came as a final step of a long-term strategy to see Enel strengthen its position in LATAM as an integrated leader, and to become the biggest energy distributor in Brazil in terms of customer numbers. As a result of the acquisition, Brazil also became Enel’s second biggest customer market (17 million customers), after Italy.

In December 2018, six months after the merger, Eletropaulo was rebranded as Enel Distribuição Sao Paulo, and adopted the parent company logo.

As part of the brand launch, Enel agreed to invest US$3.1 billion in the company over the following three years. This was just the first stage of the integration progress, which was followed by improving service quality, and adopting the most advanced distribution network technology in the country.

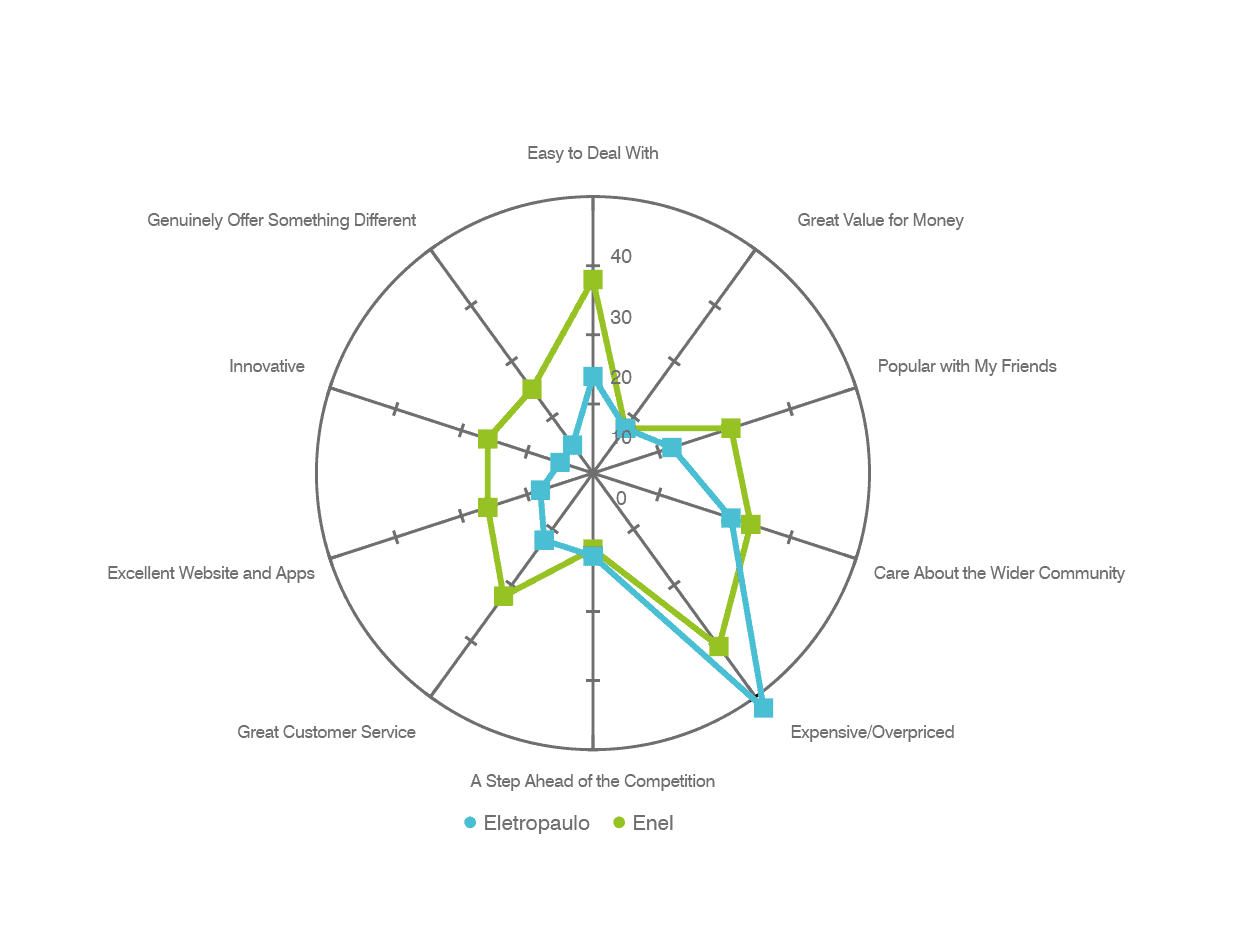

As we have collected brand perception information on the utility industry worldwide for the last four years, we were able to review general perceptions of Eletropaulo and Enel at the point of rebranding.

The results clearly expose that Enel was perceived as a much better brand than Eletropaulo: better value for money, better service, and a generally more responsible company.

The Rebranding Process

Enel transitioned their brand over the period of six months, and rebranding was completed in December 2018.

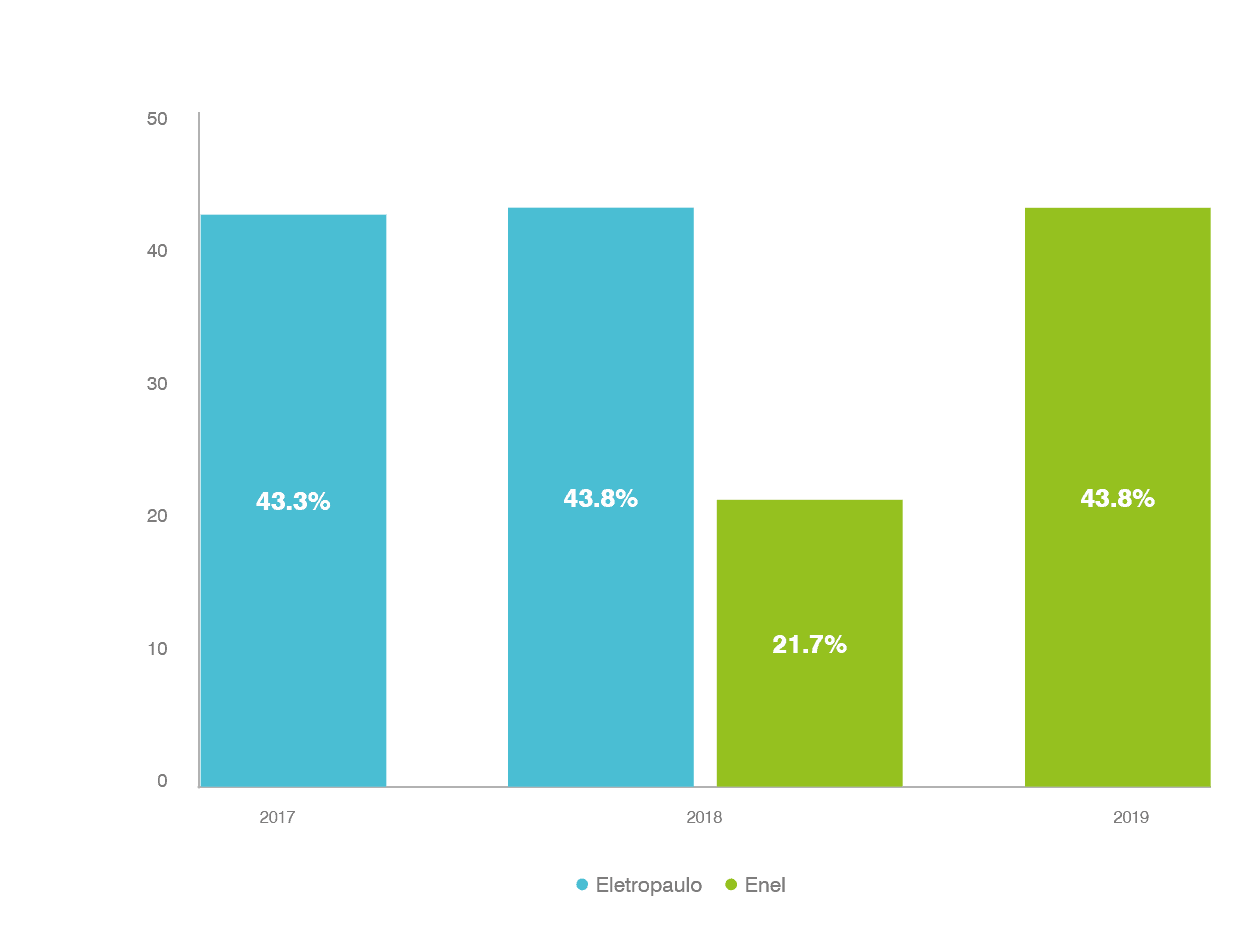

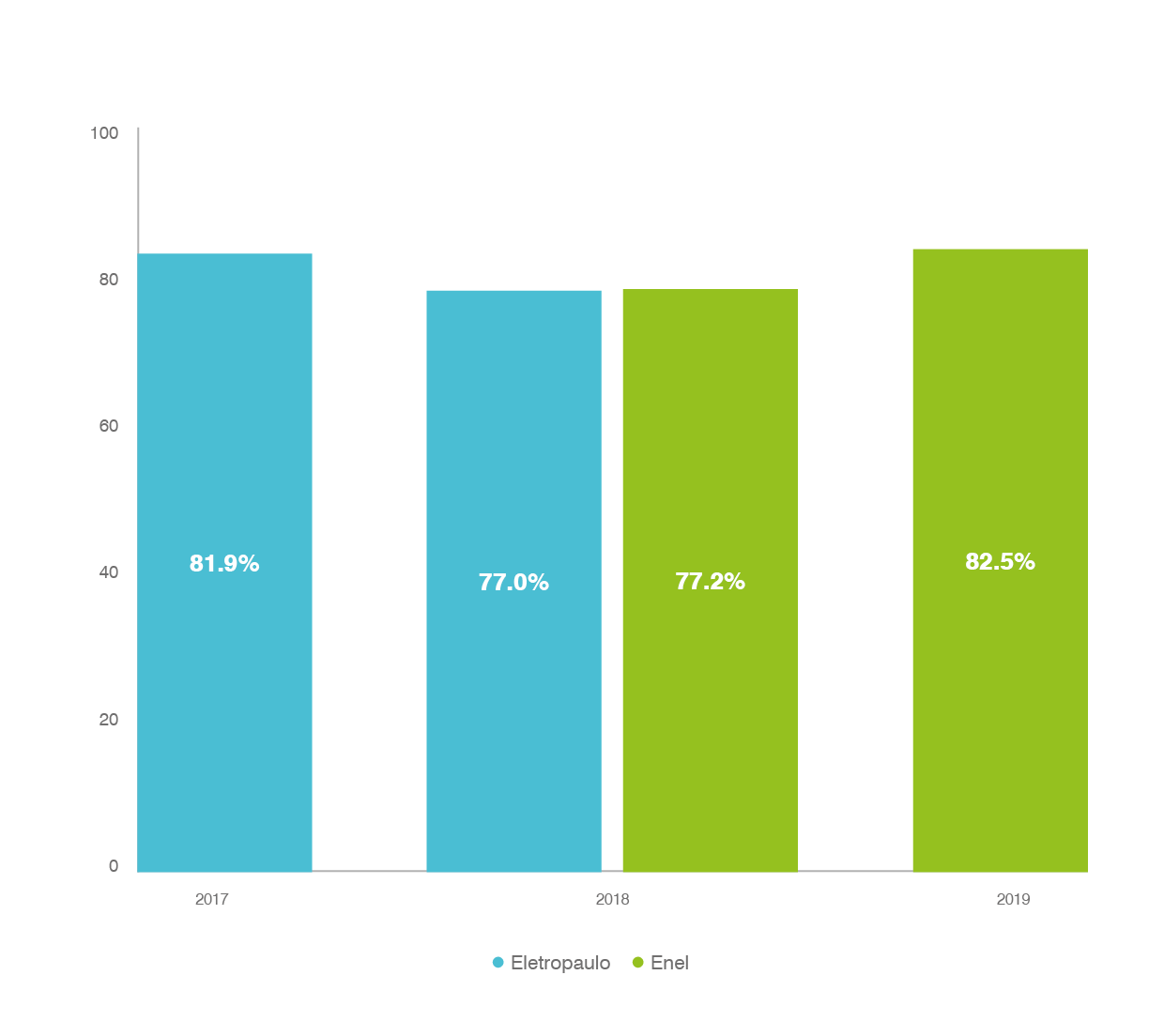

Before the transition, Familiarity with the Enel brand was considerably lower than with Eletropaulo and Consideration to use the brand was similarly low.

However, Enel’s large investment in the new brand, combined with careful planning and a market receptive to change, meant that familiarity and consideration were rapidly reclaimed, and customers were more likely to consider Enel than they were Eletropaulo pre-acquisition.

Sustained investments and well-considered execution allowed Enel to set the basis to further develop its brand and business strategy, improving brand perceptions and awareness.

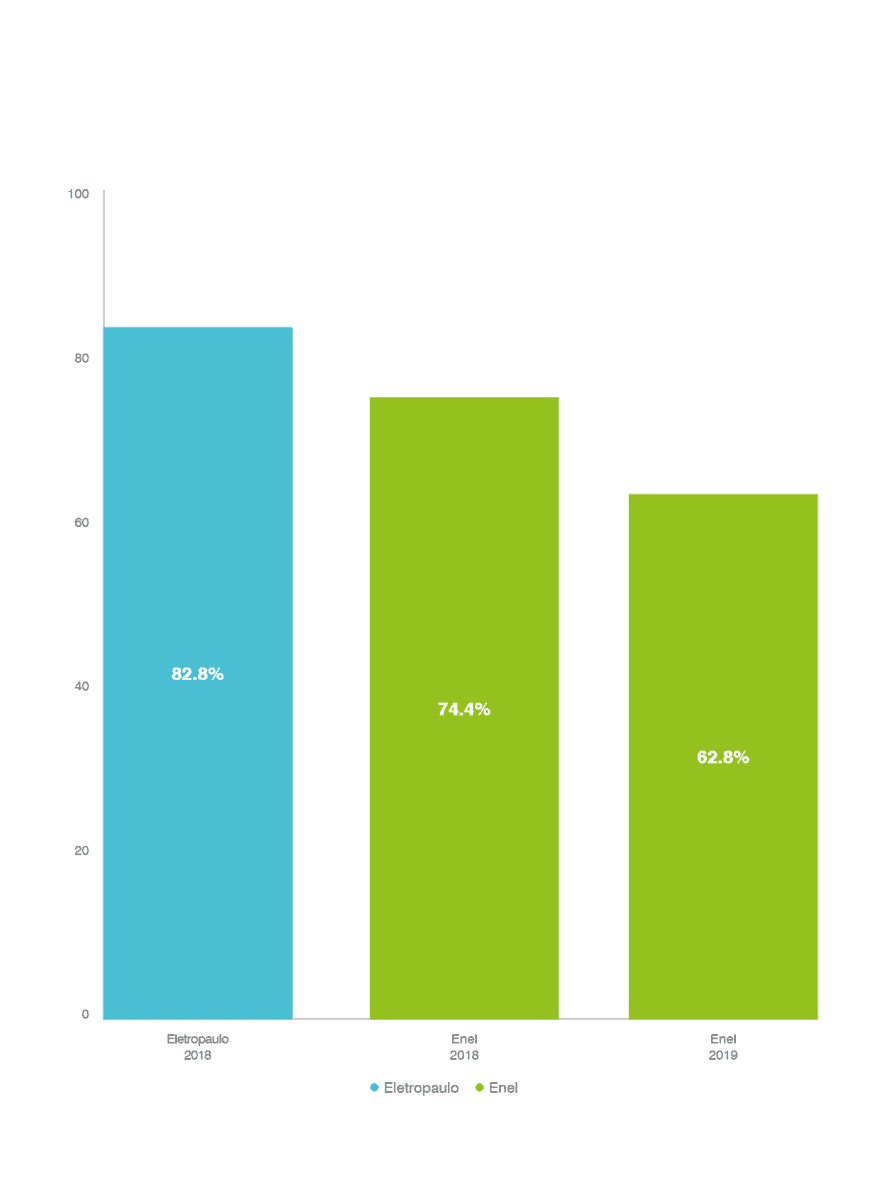

Yet, despite this positive effect on consideration in the market, loyalty for the business started to fall following the rebrand. This is an effect regularly seen during rebrands as some customers reject the new brand. However, in this case, some of the loyalty can be explained by a general opening up of the market to competition.

Enel's Rebrand Performance

On the back of the news of the Enel acquisition alone, and prior to the rebrand in December 2018, customer numbers in Brazil jumped by 100,000 to 17.1 million. Brazil is now Enel's second most important market after Italy.

By 2019, Enel’s customer numbers had risen by another 200,000; the rebrand proved successful and well-executed. Enel’s share price also considerably outperformed the sector in the year following the rebrand.

Three Key Takeaways from Enel’s Brand Transition

- Communication is Key

- Large, sustained, and consistent investment in communications is necessary to transfer positive perceptions to the new brand and increase its awareness.

- Customer Loyalty is the Long-Game Priority

- Benefits created from improving perceptions in the general market can be reduced by falls in customer loyalty.

- Customers Need Reassurance

- Reassuring existing customers that the rebrand will be positive to them is an element of the rebranding process that should not be overlooked.

Click here to read the Brand Finance Global Rebrand and Architecture Tracker (GReAT™) 2020 report and watch the Brand Finance Institute webinar "Brand Transition: Do Rebrands Add or Destroy Value After M&A? A Quantitative Study" to learn more.