Why a financially oriented approach to sponsorship evaluation needs to be considered by Sponsorship Directors, CMOs, CFOs and CEOs in order to get a true sense of sponsorship ROI.

With such high levels of investment into sports sponsorship and the inherent opportunities and risks involved, often a lot of money can be left on the table. Sponsorship is no different from any other form of marketing expenditure - it requires clear and concise evaluation against its aims to justify its existence and ultimately its associated expenditure.

In terms of expressing the return on sponsorship investment, a financial audience will typically require an evaluation based on financial payback, or ROI. i.e. how has the investment affected both top and bottom-line performance of the organisation? In this article, we will explore the typical approaches to sponsorship valuation, in order to get a true sense of sponsorship ROI.

Act with confidence. Make sponsorship and brand partnership decisions using hard data. See our Consulting Services for more information. Or contact us directly. We love to talk.

Defining Corporate Sponsorship

Brand Finance defines corporate sponsorship as a form of advertising in which companies pay to be associated with certain events or rights holder assets to promote their brand.

Pre-eminent public relations academics Tench and Yeomans go a step further. The defined sponsorship as “The totality of market-orientated decision processes about the provision of money, services, know-how or in-kind support of corporations or organisations to individuals, groups or institutions from the area of sports, culture, charity, ecology, education or broadcasting, in order to achieve specified corporate communication goals via the commercial and psychological potential associated with this activity.” 1

Despite its definition, all agree that Sponsorship is one of many tools in the marketer’s toolkit, to be employed as an integrated strategy to influence target customers, raise brand awareness, enhance corporate image and/or consumer attitudes, which may lead to future purchase intent.

Sponsorship in Sports

Sports is the area where sponsorship has made the greatest strides. Studies typically show sponsorship in sports eclipses all else, commanding a share of between 50% and 70% of all sponsorship. So why are brands continuing to invest so much money into sports over other categories? At the heart of this is the unrivalled power of sports to create positive associations between the team, league or sportsperson and the corporate brand.

At the heart of this is the unrivalled power of sports to create positive associations between the team, league or sportsperson and the corporate brand.

Sporting brands exhibit the ability to create powerful emotional connections with their fans which many corporate brands are unable to match. A study done by Barclays on fans of various English Premier League clubs showed that the average heart rate of a fan when their team conceded or scored could increase 215.5% above its resting level. This means that watching a football game can feel as intense as playing on the field in the thick of the action.

This captivating, emotionally driven sport has always been an indispensable vehicle for brands to reach fans through something that is very close to the heart. As a result, many corporate brands look to sponsorship to develop this connection through association.

Sponsorship also works at a cognitive belief level too, being able to influence the image and perceptions of a brand, which is amplified within the arena of sports. These, as well as general behaviour tendencies of the consumer, collectively influence attitudes towards a brand and ultimately affect future purchase intent.

However, it is important to note that the goals of the company need to be carefully considered when making sponsorship decisions. A company must decide if they are looking to raise brand awareness, enhance corporate image or change customer attitudes.

There must also be a good fit between the sponsor and the property in order to properly reach the target market and capture their emotional attachments. If the image associated with a particular sport, event or sports personality is not aligned with a sponsor’s brand and target audience, then the sponsorship return would be negligible or potentially even damaging.

With such high levels of investment in sports sponsorship and the inherent opportunities and risks involved, often a lot of money can be left on the table. Evaluation of sponsorship arrangements, both current and future can play an important role in determining the return on investment, the performance of sponsorship against key KPI’s and to convince partners to be invested in the long-term.

Sponsorship is no different from any other form of marketing expenditure - it requires clear and concise evaluation against its aims to justify its existence and ultimately its associated expenditure.

Measuring the Value of Sponsorship

There are many approaches to valuing sponsorship, the most common being Advertising Value Equivalency (AVE). AVE is an attempt to measure the size of the sponsorship coverage gained, its placement and a calculation of the equivalent amount of space if paid for as traditional advertising. A multiplier can frequently be applied to the AVE valuation to allow for the credibility factor of news coverage over advertising.

The Advertising Value Equivalency approach has its place within the valuation mix but is fundamentally flawed as:

- The amount of space a story covers is irrelevant if the article is critical of the client or if the clients’ competitors are favoured or even just included as well.

- The use of multipliers is simply arbitrary.

- Most importantly, it merely addresses exposure rather than the effectiveness of sponsorship across its intended audience group. i.e. it fails to highlight the consequence of sponsorship exposure such as changes in stakeholder perceptions, sentiment, shifts in stakeholder behaviours towards the brand and ultimately the impact on the financial performance of the underlying business.

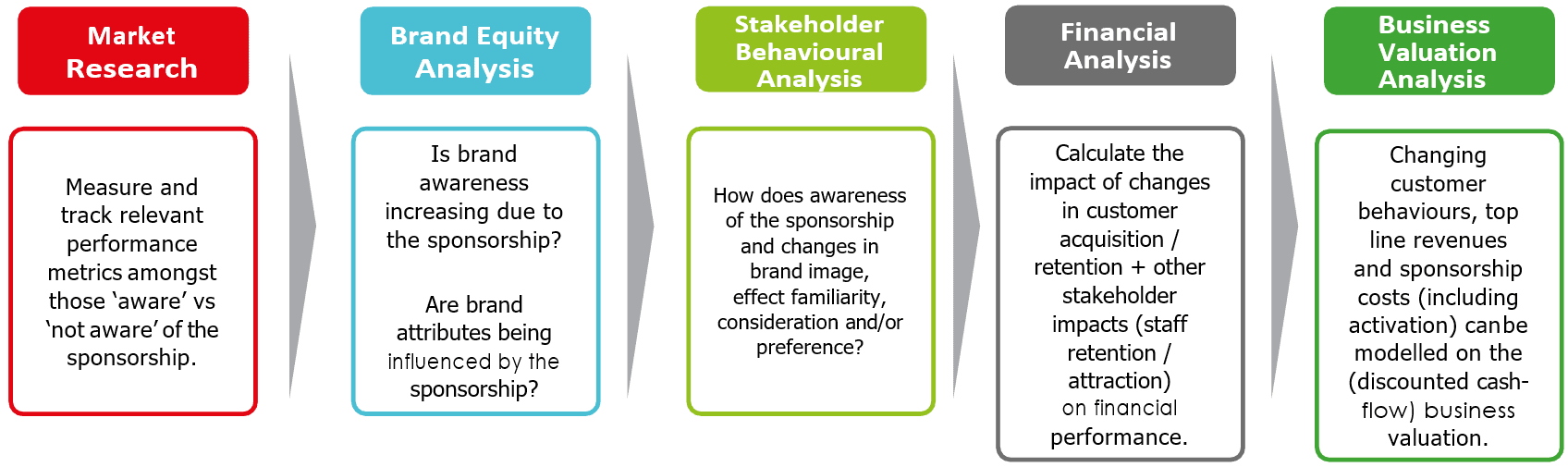

Aside from Advertising Value Equivalency (AVE), other valuation approaches include some form of market research. Market research helps to identify the impact of sponsorship on key sponsor brand and marketing funnel metrics and KPI’s. This helps to bring out insights on brand image, brand awareness, and how the association with the rights holder has shifted the dial on these various metrics.

The relationship between sponsor and sponsee is special. Each year we rank the 50 most valuable football clubs. This includes detailed analysis of these top clubs' relationships with their sponsors.

However, for the reasons outlined above, these approaches often fail to meet the standard required at CFO, CEO and certainly at Board level. They fail to express the effectiveness of sponsorship in a language familiar with key decision-makers such as the CEO and CFO. In terms of expressing the return on marketing investment, a financial audience will require an evaluation of sponsorship investment based on financial payback, or ROI. i.e. how has the investment affected both top and bottom-line performance of the organisation?

These crucial questions should form part of your sponsorship effectiveness checklist when evaluating how successful your campaign or relationship has been:

- What impact is the sponsorship having on long-term brand building metrics of the organisation such as awareness and brand equity?

- What impact is the sponsorship having on your short-term business performance?

- What is the ROI dollar value from the sponsorship investment annually and over the term of the deal? Is it money well spent?

- How does the sponsorship ROI compare to other similar sports sponsorships?

- Are we paying too much?

- Should the sponsorship be renewed, and if so at what fee?

- Is the sponsorship a good fit for our commercial objectives?

Value-Based Approach to Sponsorship Valuation

A valuation-based approach to sponsorship evaluation provides a practical, logical and commercially driven basis for assessment. Through an approach that establishes linkages between changes in brand equity, stakeholder behaviour and ultimately business and brand value, a solid platform of insight to inform future sponsorship decision making.

Understanding a sponsorship’s contribution to business performance (value) through a discounted cash-flow valuation model provides true firepower at the negotiation table with existing and potential sponsors.

Case Study: Financial Services Group & a National Football League

A prominent International Financial Services Group entered into a long-term naming rights sponsorship agreement with the highest division of a national football league system.

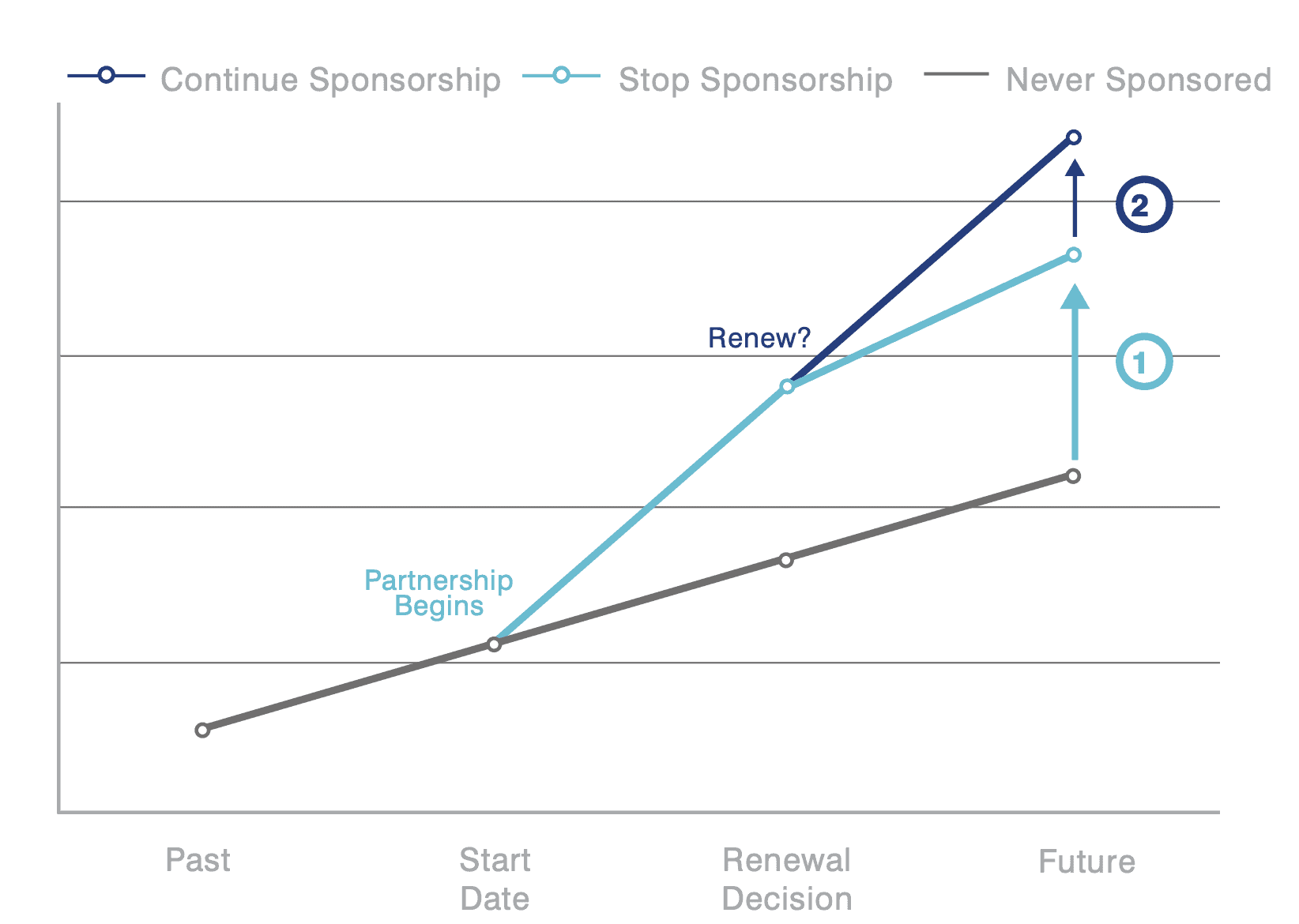

As the completion date of the existing sponsorship deal term approached, the financial services brand required an evaluation and valuation of the sponsorship deal to inform decision making relating to the possible renewal of the deal beyond the existing term.

The financial services brand was looking to understand the value-added to the business by the sponsor relationship since its launch, and the value to be gained or lost by renewing the sponsorship.

A five-step approach was taken to understand the impact of the Football League sponsorship on the Financial Services Group business value up to 2019, the potential into the future, and the cash delivered since its inception.

- Branded Business Valuation: Adaptable financial model of the business to allow for scenario modelling.

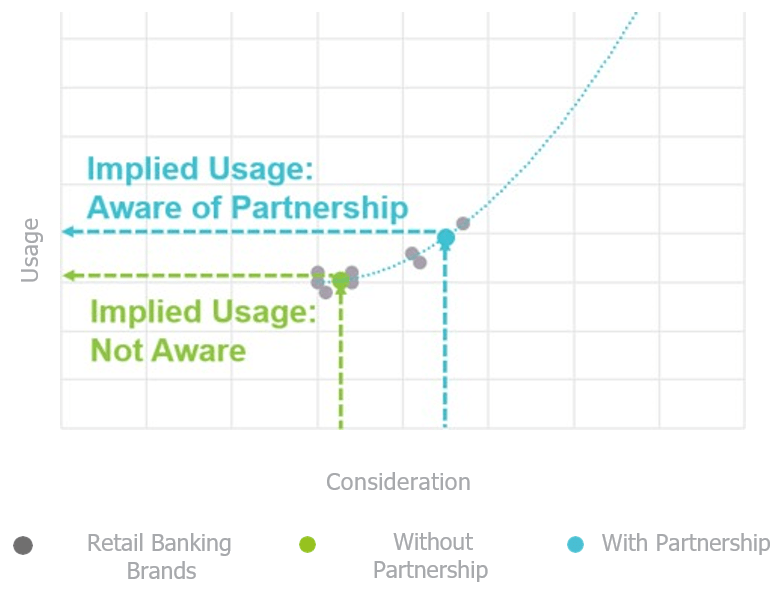

- Effect of partnership on customer consideration and perceptions: Understand brand perception differences between those aware and not aware of the sponsorship.

- Linking brand perceptions to business value drivers: How the customer numbers, acquisition, retention and churn are affected by the sponsorship.

- Sponsorship Valuation (Business Value Impact): Apply adjusted customer numbers to the business model to find the financial impact.

- Return on Investment Analysis: Comparing total expenditure since the start of the sponsorship to the cash flow advantage delivered.

1. Branded Business Valuation

This step is to establish the current enterprise value of the business that operates under the brand. In this case, the value of the Financial Services Group enterprise was determined in order to establish a baseline from which the sponsorship effectiveness was determined.

All business segments that may be influenced by the partnership are valued using the discounted cash flow methodology and corroborated by using market multiples.

2. Effect of partnership on customer consideration and perceptions

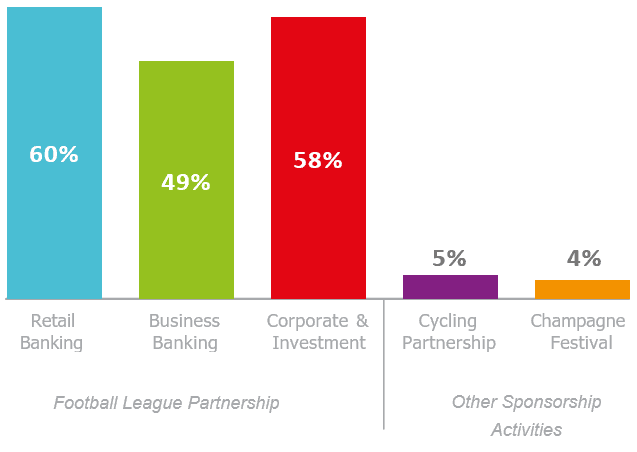

Stakeholder research was then analysed to understand the impact of the sponsorship across customer segments, including levels of awareness, Financial Services Group brand perceptions and consideration for the Financial Services Group brand.

The results showed Strong sponsorship awareness amongst Financial Services Group consumers and business audiences. The comparison between the football sponsorship and other more niche partnerships showed how there is little benefit to creating a strong positive effect on perceptions if only a few consumers are affected or if there is a widespread awareness but no positive effect on perceptions. A good return depends on the sponsorship activity enhancing positive image attributes among a large proportion of the consumer base.

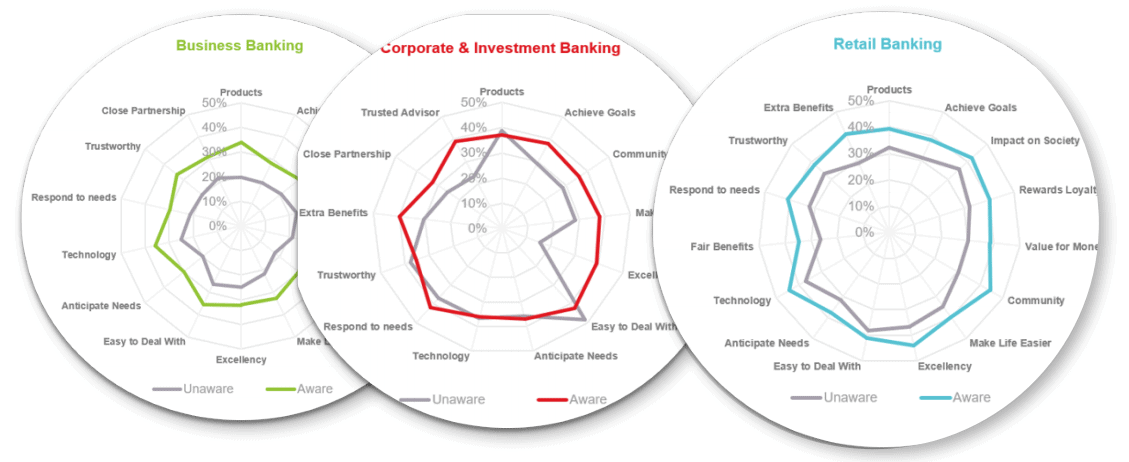

The percentage of respondents strongly agreeing that Financial Services Group had a range of positive image attributes was generally higher among those aware of the Football League sponsorship.

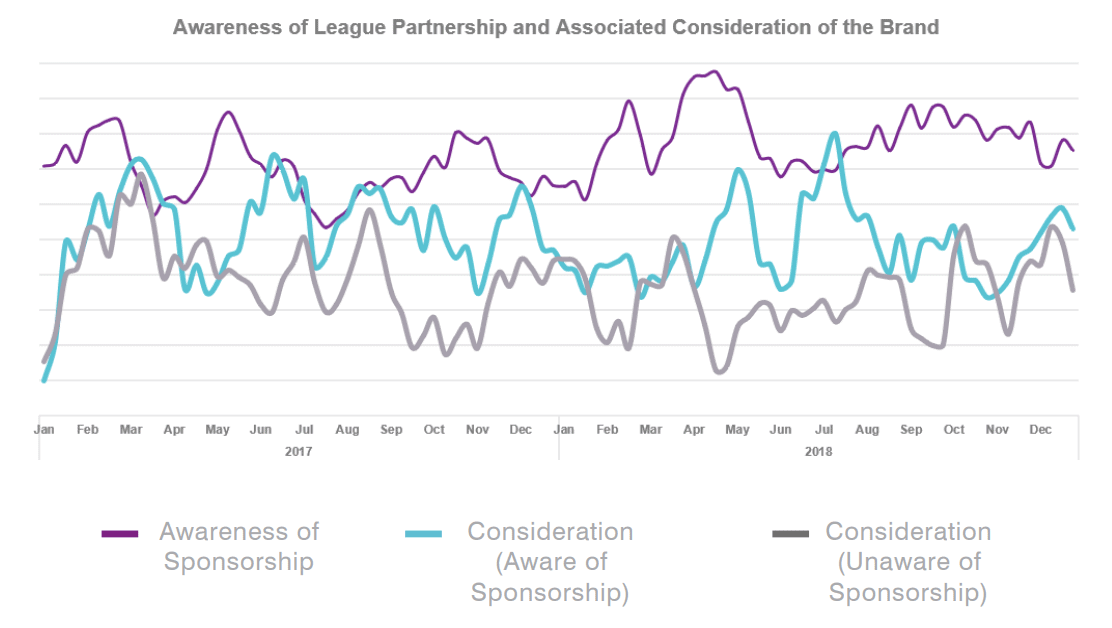

The increased consideration seen among those aware of the sponsorship is not limited to a point in time – the effect can be seen consistently for the retail bank for the past two years. Those aware of the sponsorship were more likely to consider in 83 of the 96 weeks researched. Consideration difference peaks July 2018 – 60% vs 33% – an 82% uplift vs unaware.

3. Linking brand perceptions to business value drivers

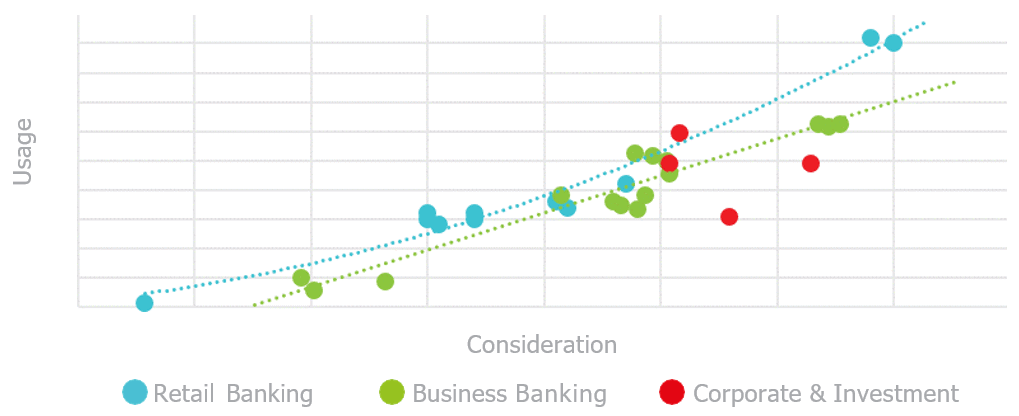

Statistical analysis was undertaken to identify relationships between Financial Services Group brand perceptions and brand consideration, as well as brand consideration and brand usage (acquisition). This analysis provides a basis to understand the customer numbers and therefore the revenue impact on the Financial Services Group business model over a period.

Improved stakeholder image perceptions influenced customer behaviours, especially brand consideration, which is a major factor in customer acquisition.

Retail banking market research showed that stronger perceptions correlated with greater spontaneous brand consideration.

Increased consideration delivers incremental benefits to the business, and for a bank, this is primarily through increased customer acquisition and reduced churn.

4. Sponsorship Valuation (Business Value Impact)

The value delivered by the sponsorship across each Financial Services Group business segment arises from greater awareness and consideration of the Financial Services Group brand, which feeds through to increased usage minus annual sponsorship costs which would include activation expenditure. Both revenue and cost impacts were modelled in an annual forecast DCF valuation model.

5. Return on Investment Analysis

The value delivered by the sponsorship in Retail Banking arises from greater awareness and consideration of the brand, which feeds through to increased usage.

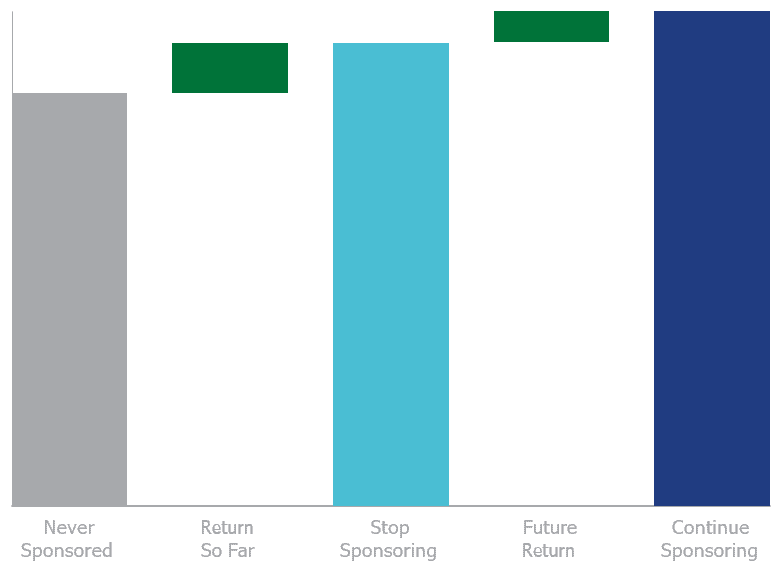

The investment delivered positive results – Significant value has been delivered, with potential for further gain if renewed.

The findings and recommendations provided by Brand Finance were circulated among the marketing team, as well as at board level in order to make an informed decision on renewal. The results were disseminated among the wider marketing team. This was used internally as part of discussions on whether the contract should be renewed and at what fee.

The findings were used in the ongoing negotiations between the Bank and the rights holder, in order to determine whether the contract should be renewed and at what fee.

Conclusion

When embarking on a new sponsorship, or considering the renewal of an existing sponsorship, whether you are a rights holder or a corporate brand, one must ask themselves ‘Do I have a framework in place to quantify the ROI dollar value to maximise effectiveness, inform decision making and increase negotiation leverage.’

With such high levels of investment in sports sponsorship, a lot of money can be left on the table. As such, there is a requirement to improve the sophistication of sponsorship valuation, to provide a basis of valuation in the language of the CFO, CEO and Board who are often the key decision-makers.

- Tench, R. and Yeomans, L., 2011. Exploring Public Relations. Harlow [etc.]: FT Prentice Hall.[↩]